AI Stocks Propel Markets to New Highs: Evaluating Sustainability, Risks, and Long-Term Growth Potential

AI stocks continue to drive major indices to record highs, but are valuations sustainable? Examining the true impact of AI on corporate earnings and whether we’re in a tech supercycle or speculative mania. Key investment opportunities and risks as AI reshapes the financial landscape.

The AI revolution, which has only grown to be more obvious in the past few months, has created an incredible market boom as top benchmarks soared to record highs, driven by investor enthusiasm. Regular investors, analysts, and experts alike have watched Nvidia, Microsoft, Alphabet, and other AI giants clock incredible returns to fuel valuations into new history. However, as new entrants enter the market and fall under increased regulatory scrutiny, the question looms over the question: Is this the start of a sustained supercycle, or are we seeing the early signs of a speculative bubble?

Few stocks have encapsulated the AI-driven stock surge so comprehensively as Nvidia (NASDAQ: NVDA). The giant chipmaker whose processors power artificial intelligence models around the world has seen its shares soar more than 70% in the past year alone, briefly becoming the third-largest U.S. company by market capitalization. Despite this, the AI trade runs much more profoundly through Nvidia. Microsoft (NASDAQ: MSFT) has doubled its bet on OpenAI, adding AI capabilities to its entire software stack, and Alphabet (NASDAQ: GOOGL) has ramped up its AI-based search and cloud business. Meta Platforms (NASDAQ: META) and Amazon (NASDAQ: AMZN) are also deepening their AI penetration, from ad to cloud. The enthusiasm can be seen in the large indexes. The Nasdaq-100 has increased nearly 50% since the start of 2023, with AI shares making most of the gains. The S&P 500 has followed suit, driven by what some refer to as the "Magnificent Seven"—a band of tech titans leading the AI revolution.

To further understand why exactly these companies are experiencing so much success. Nvidia for example, has been at the forefront of this revolution, making regular headline appearances in Q4 2024. As the development and training for AI requires increasingly more powerful GPUs and data processing machines, both tech and data companies willing to invest in long-term storage, like Nvidia, have been able to soak up much of these industry tailwinds.

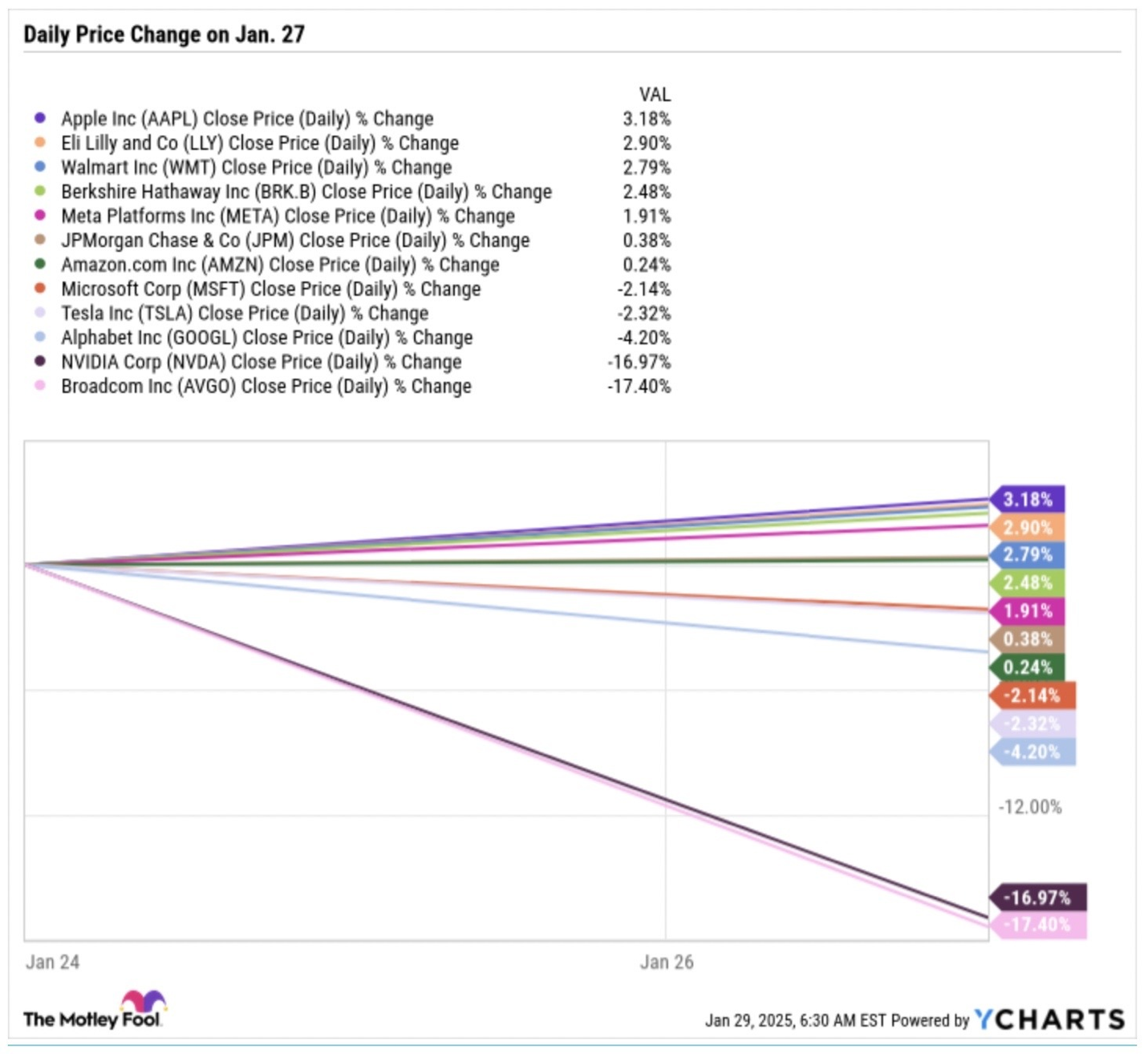

For all the optimism, cracks are beginning to show. In late January, investors received a stark reminder of AI’s disruptive power when Chinese AI startup DeepSeek introduced a low-cost, high-performance AI assistant, sending shockwaves through the sector. Many large American tech companies like Nvidia for example, long seen not only as the dominant force in the market both for its first moving advantage but sheer size, saw its stock plummet 17% in a single session, erasing $593 billion in market value—the largest one-day decline in Wall Street history.

In fact, it was not only Nvidia which felt the ripples of this new revelation. Other major tech companies also experienced varying levels of loss of valuation.

The panic stemmed from fears that DeepSeek, which claims to have developed models rivaling OpenAI’s ChatGPT at a fraction of the cost and time spent training, could upend the AI hardware landscape. With demand for high-end chips potentially softening as software alternatives gain traction, investors rushed to reprice the AI trade. Despite the shock, Nvidia shares have recovered since, buoyed by optimism about its upcoming Blackwell AI chip, which will provide higher performance and efficiency. Nevertheless, the experience is a reminder: AI dominance is not a certainty, and competitive threats can emerge rapidly. Aside from the competitive risks, AI stocks are at risk from escalating geopolitical winds. DeepSeek's success has been preceded by rising scrutiny as U.S. and international regulators raised alarms over security and data privacy issues. South Korea recently suspended DeepSeek's AI app downloads over risk to user data. Various U.S. states, including Texas, New York, and Virginia, prohibited DeepSeek use on government computers owing to concerns over data access by the Chinese government, followed by various educational institutions across North America.

With AI shares at an all time high in terms of valuations, some observers perceive uncanny similarities to the dot-com bubble in the late 1990s. As of now, Nvidia costs almost 50 times current earnings and around 30 times forward earnings, and AI-powered newcomers with tiny revenues have gained multi-billion-dollar market caps overnight. Similarly, during the dot-com mania, investors participated in internet shares on the expectation that a tech revolution would change the economy for good. While some success did sprout from this optimism - Amazon, Google, and Apple did become trillion-dollar giants, but for every Amazon, there happened to be dozens of Pets.com-style catastrophes.

For investors, artificial intelligence remains one of the decade's greatest growth themes. But with danger high, it's smart to be discriminating. The top contenders to succeed over the long term will be those companies with stronger earnings growth, impregnable market leadership, and lasting competitive advantages.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.