ArcStone Financial Pulse Newsletter – October 2024 Edition

ALT5 Sigma Announces Strategic Separation, Enhancing Value for Shareholders

On Wednesday, ALT5 Sigma (NASDAQ: ALTS) announced a bold strategic move to separate its fintech and biotech businesses into two distinct entities, leading to a dip in shares during premarket trading. This separation follows the company’s acquisition of fintech innovator ALT5 Sigma, a leader in crypto payment processing and digital asset infrastructure, earlier this year.

After the separation, ALT5 Sigma will continue as a pure-play fintech company, while its biotech division will emerge as Alyea Therapeutics Corporation, an independent firm focused on non-addictive pain management therapies. This strategic split is expected to unlock significant value for shareholders by enabling each entity to focus more sharply on industry-specific growth strategies.

As separate companies, ALT5 Sigma and Alyea Therapeutics will benefit from increased operational agility, allowing them to allocate capital more effectively and tailor their business strategies to meet the evolving demands of their respective industries. ALT5’s board unanimously approved this decision following a comprehensive evaluation of strategic alternatives, initiated after the fintech acquisition in May.

ALT5 Sigma’s Fintech Growth – Capitalizing on the Crypto Boom

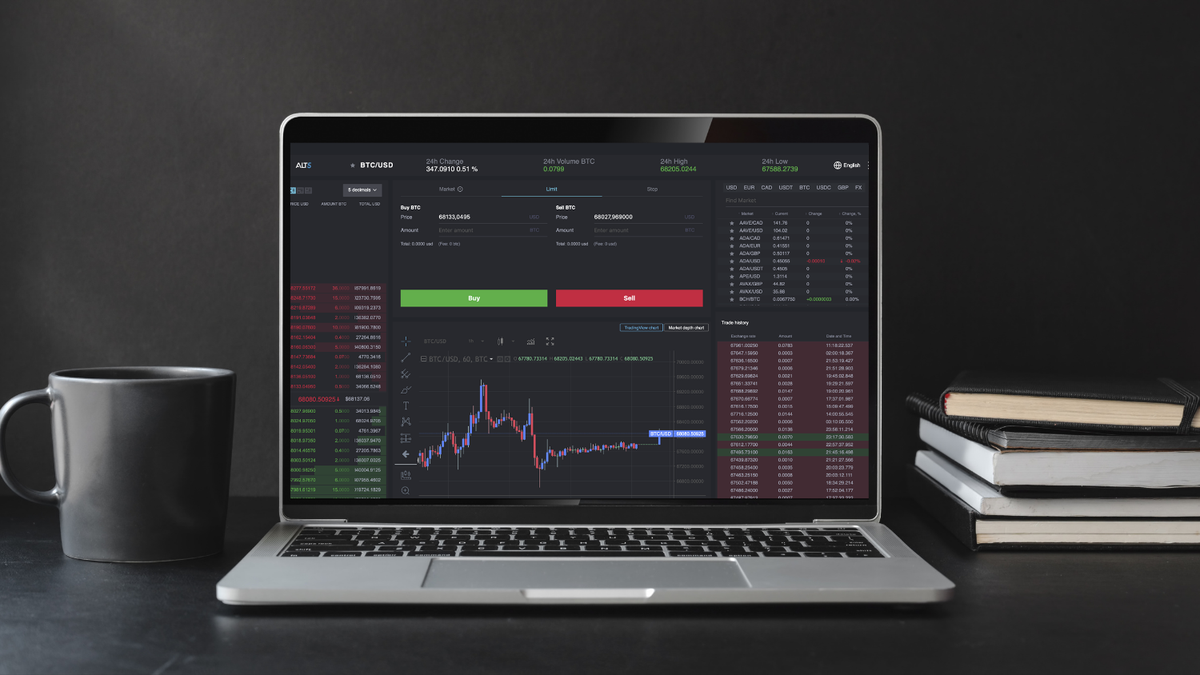

ALT5 Sigma’s fintech division, which includes ALT5 Pay and ALT5 Prime, is well-positioned to thrive in the rapidly growing crypto payment processing sector. As global adoption of digital currencies continues to accelerate, the demand for secure, scalable, and compliant infrastructure is increasing. ALT5 Pay’s transaction volumes have surged, reflecting rising customer engagement and the expanding utility of crypto as a medium of exchange across industries.

In parallel, ALT5 Prime offers a platform tailored for institutional investors and enterprises looking to integrate digital assets into their portfolios. This focus on both retail and institutional markets has fueled ALT5 Sigma’s growth, establishing it as a key player in the digital asset space.

The value proposition of crypto payment processing is increasingly evident. By offering cost-effective, secure, and fast transactions, companies like ALT5 are playing a crucial role in modernizing financial infrastructure. In fact, digital payments are projected to account for 20% of all e-commerce transactions globally by 2025, underscoring the potential for significant growth in this space.

The Strategic Impact of a NASDAQ Listing

For fintech companies like ALT5 Sigma, a NASDAQ listing offers several strategic advantages, particularly in attracting institutional capital and enhancing brand credibility. Listing on the NASDAQ positions ALT5 among top-tier tech and financial companies, opening doors to new investor bases that prioritize innovation and market leadership.

Moreover, NASDAQ-listed companies typically benefit from increased visibility in the global financial markets, improved liquidity for shareholders, and a more favorable environment for raising capital through equity offerings. For ALT5, this is particularly important as it continues to scale its fintech operations and explore new markets for growth, including crypto payment processing and digital assets infrastructure.

Why This Matters for Investors

The separation of ALT5’s fintech and biotech divisions allows both companies to pursue targeted growth strategies while maximizing value for shareholders. For investors, this means a clearer focus on fintech innovation through ALT5 Sigma, while Alyea Therapeutics will drive advancements in biotech with non-addictive pain management solutions.

As crypto adoption continues to grow, ALT5 Sigma’s role in the digital asset space positions it for significant long-term growth. Investors seeking exposure to both the fintech and biotech industries will find this strategic split a compelling opportunity to diversify across two high-growth sectors.

Stay tuned to ArcStone Financial Pulse for more insights on global markets, fintech, biotech, and the latest investment opportunities.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading boutique investment bank specializing in equity capital markets, M&A advisory, and cross-border financial solutions. With a focus on innovative growth strategies, ArcStone partners with global investors to help companies access capital, execute transformative transactions, and achieve sustainable growth across key markets.