Fintech Disruption: Transforming Banking and Investing

The financial services sector is on the brink of a paradigm shift as financial technology disrupts the traditional banking and investing ecosystem. What started as niche applications in payments and lending has now evolved into a comprehensive suite of solutions that include digital wallets, blockchain-based systems, artificial intelligence-driven wealth management tools, and embedded finance. This evolution is driven by increasing consumer demand for convenience, speed, and personalized experiences, forcing legacy financial institutions to either innovate or risk becoming obsolete.

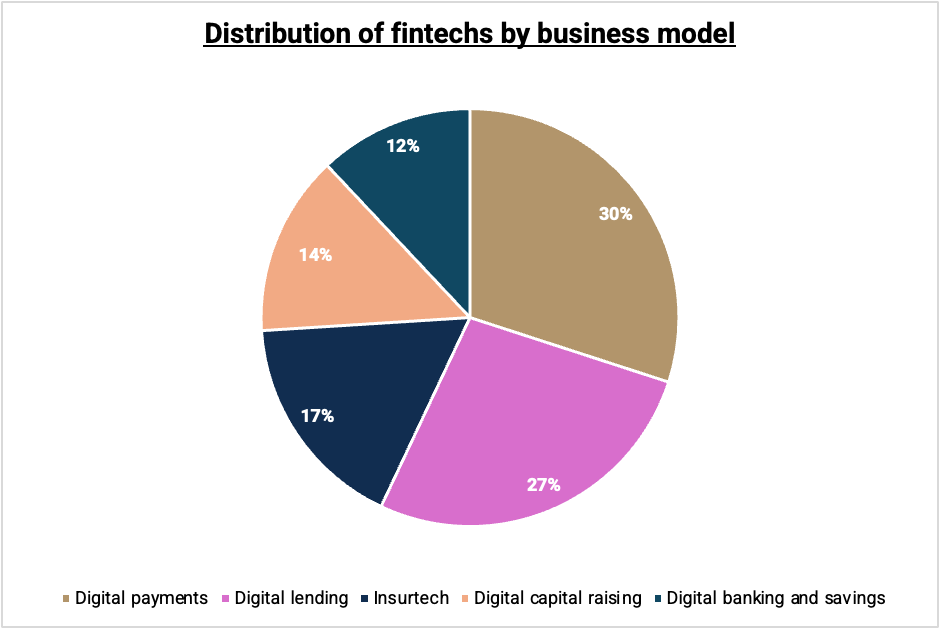

The global fintech market is expected to reach a market value of $1.5 trillion by 2030, growing by 4.7x from 2024. The rapid adoption of fintech is not limited to startups—traditional banks and tech giants alike are entering the space, creating a hyper-competitive environment. However, this fast-paced growth comes with its own challenges. Fintech companies must navigate a landscape fraught with regulatory scrutiny, rising cybersecurity threats, and shifting consumer trust dynamics. For investors, understanding how fintech leaders address these challenges is vital to identifying long-term winners in this transformative space.

Signals of Change in Fintech

The demand for financial services has shifted dramatically over the past decade. Consumers now expect instant access to financial products through mobile apps that offer intuitive interfaces and a personalized experience. This trend has given rise to embedded finance, where financial services like lending, payments, and insurance are seamlessly integrated into non-financial platforms. For example, Shopify, one of the leading e-commerce platforms, now offers its merchants integrated lending and payment solutions through Shopify Capital and Shop Pay. This model allows users to access financial products directly within the ecosystem they already use, reducing friction and enhancing user experience.

However, the shift to digital financial services has raised concerns about data privacy and cybersecurity. In a survey by KPMG, 86% of respondents expressed growing concerns about data privacy, while 78% worried about the volume of data being collected. To address these concerns, leading fintech companies like Stripe and Square are investing heavily in security infrastructure. Stripe, for instance, uses advanced encryption and tokenization technologies to safeguard payment data, setting a benchmark for secure online transactions.

Leading Players Shaping the Industry

Several fintech companies have emerged as trailblazers, setting new standards in innovation and customer engagement. PayPal, one of the earliest disruptors, revolutionized online payments and continues to expand its ecosystem with services like Venmo, a peer-to-peer payment app that has become a cultural phenomenon in the U.S. In 2023, PayPal processed$1.36 trillion in payment volume, showcasing its dominance in the digital payments space.

Similarly, Square has made significant strides in democratizing financial tools for small businesses. Its Square Point of Sale system enables merchants to accept card payments, manage inventory, and access analytics, all from a single platform. Beyond payments, Square has ventured into consumer banking with its Cash App, which offers features like direct deposits, stock trading, and Bitcoin transactions. In 2023, Cash App generated $14.68 billion in revenue.

On the consumer lending front, Affirm has redefined how people finance purchases. By offering buy-now-pay-later (BNPL) options, Affirm has tapped into a market of consumers who prefer flexible payment plans over traditional credit cards. The company’s partnerships with major retailers like Amazon and Peloton have helped it capture significant market share.

Source: WEF

The Role of Technology in Fintech

Technology is the backbone of fintech innovation, enabling companies to develop products that are faster, safer, and more accessible. Blockchain technology, for instance, has introduced decentralized finance (DeFi) solutions that eliminate intermediaries, allowing users to transact directly. Companies like Coinbase and Binance are pioneers in this space, offering platforms for trading cryptocurrencies and staking assets. Despite market volatility, the potential for blockchain to transform cross-border payments and financial inclusivity remains immense.

Generative AI is another game-changer in fintech. Companies like Upstart are using AI-driven algorithms to assess creditworthiness, offering loans to customers who may have been overlooked by traditional credit scoring models. This approach not only broadens access to credit but also reduces default rates by leveraging more comprehensive data points. Meanwhile, robo-advisors like Betterment and Wealthfront are applying AI to offer personalized investment advice, helping clients optimize portfolios based on their financial goals and risk tolerance.

Cloud computing has also emerged as a cornerstone of fintech infrastructure. Mambu, a cloud-based banking platform, enables traditional banks and fintechs to deploy new products rapidly without the burden of maintaining on-premises systems. This modular, scalable approach has attracted partnerships with major players like Santander and ABN AMRO, demonstrating how cloud solutions can bridge the gap between legacy systems and modern customer expectations.

Challenges and Opportunities in Regulation

Regulatory oversight has intensified as fintech companies expand their offerings. Governments worldwide are addressing risks associated with digital currencies, cross-border transactions, and data protection. Central bank digital currencies (CBDCs) represent a significant area of focus. With 86% of central banks exploring or piloting CBDCs, companies like Ripple are positioning themselves as key enablers of this transition. Ripple’s blockchain-based solutions aim to facilitate faster and more secure cross-border payments, aligning with central banks’ objectives.

However, the regulatory landscape is not without its challenges. To mitigate such risks, companies are embedding compliance frameworks into their operations. For example, SoFi, an online financial services provider, has integrated robust risk management processes to secure its banking license. This proactive approach not only safeguards against regulatory penalties but also builds trust among customers and stakeholders.

The Road Ahead

Fintech’s trajectory is marked by both immense opportunities and formidable challenges. Companies that succeed will be those that combine technological innovation with a deep understanding of customer needs and regulatory requirements. As embedded finance, DeFi, and AI-driven solutions gain momentum, the fintech sector will continue to attract investment and redefine the boundaries of traditional finance.

For investors, the key lies in identifying companies that balance growth with profitability while maintaining a strong focus on compliance and trust. The fintech revolution is not just reshaping financial services—it is setting the stage for a more inclusive, efficient, and innovative financial ecosystem.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.