Fixed Income Market Trends: Shifting Investor Sentiment Amid Economic and Political Uncertainty

Investor sentiment in the fixed income market is undergoing a shift as global economic and geopolitical landscapes continue to evolve. In the week leading up to February 12, 2025, a combination of rising inflation, newly imposed tariffs under the Trump administration, and weaker economic data has dampened investors' appetite for risk, prompting a steady movement towards safe-haven assets like bonds.

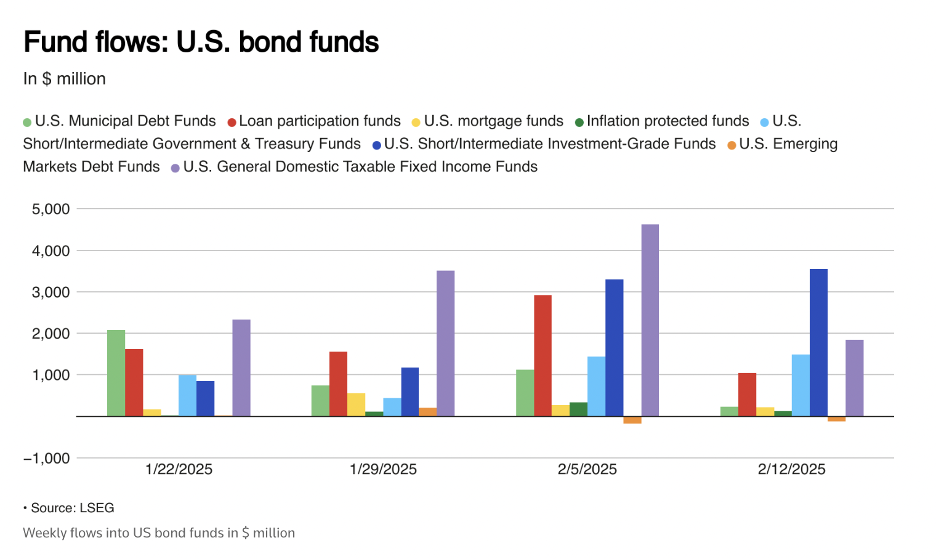

As a result, the U.S. bond market has experienced inflows for the fifth consecutive week, with net investments totaling approximately $7.45 billion over the past week alone. This sustained shift highlights the growing demand for predictable returns and stability amid market uncertainty.

Key Drivers Behind the Fixed Income Surge

To understand this shift in sentiment, it is essential to examine the underlying factors influencing investor behavior. Historically, bonds serve as a hedge against market volatility, offering predictability and steady returns—an appealing alternative to equities in uncertain times.

A major influence on bond market dynamics is the Federal Reserve's stance on interest rates. Recent inflation data suggests that rates may remain elevated for longer than anticipated, increasing the attractiveness of fixed-income investments by ensuring higher yields in a relatively stable environment.

In recent years, the fixed-income market has struggled with underperformance due to aggressive rate hikes and economic uncertainty. The severe downturn of 2022 saw bond markets take a significant hit, making recovery difficult. However, 2024 marked a notable turnaround, with inflows into U.S. bonds reaching $435 billion, according to TD Securities. Many analysts believe this positive trajectory may extend well into 2025, driven in part by a historically low equity risk premium in the S&P 500—the lowest in the past 25 years.

Geopolitical and Economic Uncertainty Driving Market Behavior

Multiple economic and political factors are influencing the fixed-income market in early 2025. The Trump administration’s trade policies have fueled investor concerns over market stability. In January, the White House introduced a 25% tariff on energy and precious metals, followed by additional auto and semiconductor tariffs impacting key trade partners such as China, the European Union, and Japan.

These aggressive trade measures have raised fears of economic instability and prolonged inflationary pressures, leading some investors to question the resilience of equity markets. The international response has been swift, with China hinting at potential retaliatory actions, including divestment from U.S. Treasuries. A large-scale selloff by foreign debt holders could exacerbate market instability and force the Federal Reserve to intervene further to stabilize financial markets.

Despite these risks, some analysts argue that President Trump’s policies are not entirely detrimental to bond markets. Some believe that recent actions—such as the creation of the "Department of Government Efficiency," headed by Tesla CEO Elon Musk—could impact investor confidence in U.S. fiscal policy. The administration’s push for budgetary oversight and national debt reduction efforts has sparked debate over whether potential reforms will strengthen or destabilize U.S. financial markets.

Industry experts, including former Council of Economic Advisers Chair Kevin Hassett, have noted that in the past, the U.S. Treasury has issued payments without clear allocation tracking, raising concerns about inefficiencies. However, the possibility of a default on American debt—even if unintended—would likely trigger a bond market shock, forcing global investors to demand higher returns due to increased political risk and inflation concerns.

Looking Ahead: Navigating an Evolving Fixed Income Landscape

Investor sentiment in the coming months will depend heavily on how the U.S. administration balances inflation management, trade policy, and fiscal oversight. While some view the administration’s policies as a necessary correction to past financial mismanagement, others fear that the aggressive approach to trade and fiscal restructuring could prolong market instability and disrupt global economic flows.

For investors, this dynamic environment calls for careful consideration of portfolio strategy. Although bond markets have experienced strong inflows, interest rate volatility remains a key concern. If inflation remains elevated or if foreign investors begin demanding greater compensation to hold U.S. debt, bond yields could rise further.

Under such conditions:

- Long-duration bonds may face price declines, making short- to medium-term fixed-income securities a more stable option.

- Credit spreads may widen, signaling increased risk in corporate bond markets.

- Investors holding high-yield or emerging market bonds should remain cautious, as deteriorating economic conditions could increase default risks.

As the landscape continues to shift, fixed-income investors will need to closely monitor market signals, Federal Reserve policy, and geopolitical developments to make informed decisions in a rapidly evolving financial environment.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.