Implications of Bank of Canada’s Aggressive Rate Cuts

The Bank of Canada delivered another interest rate cut yesterday, marking its fifth consecutive reduction and reinforcing its commitment to bolstering the Canadian economy. This latest move brings the total reduction to 175 basis points in just a few months. Today’s cut of 25 basis points signals a shift toward a more measured approach as the central Bank assesses the cumulative impact of its policy changes. The Bank’s recent cuts, while aimed at stimulating economic growth, carry profound implications for businesses, households, and investors alike. This analysis delves into the rationale behind the policy shifts, their immediate impact, and the long-term consequences for Canada’s economic trajectory.

Rationale Behind the Rate Cuts

At the core of the Bank of Canada’s decision to cut rates lies a confluence of economic pressures. By the third quarter of 2024, GDP growth had slowed to a meager 1%, far below expectations and insufficient to close the output gap. Household consumption, a critical driver of economic activity, showed signs of fatigue as high borrowing costs and stagnating wage growth constrained spending. Business investment, another essential pillar of growth, also failed to recover, reflecting a broader lack of confidence in the economic outlook.

Inflation, which had been the primary concern driving the Bank’s earlier tightening cycle, moderated significantly throughout the year. By September, inflation had fallen to just 1.6%, well below the 2% target. This decline was driven by easing energy prices, weak demand, and softening price pressures across key sectors. The lower inflationary environment gave the Central Bank the flexibility to pivot toward monetary easing, focusing on supporting growth rather than containing price pressures.

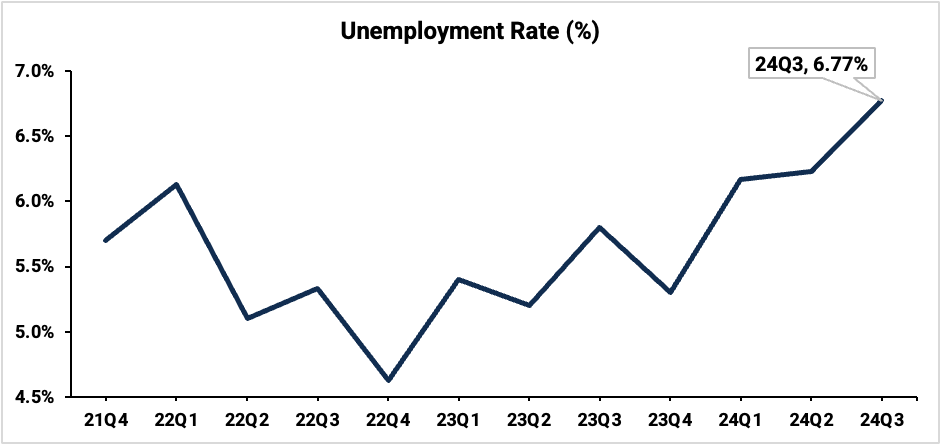

Once a source of resilience, the labor market also began to show cracks. By November, unemployment climbed to 6.8%, its highest level in three years, while the proportion of long-term unemployed individuals increased. Although job creation remained positive, the quality of employment gains raised concerns, with many new jobs concentrated in cyclical and lower-wage sectors. These challenges underscored the need for an accommodative monetary policy to stabilize the labor market and support household income growth.

Source: S&P Capital IQ

Immediate Economic and Market Reactions

The recent rate cuts have had an immediate impact on financial markets and the broader economy. In the bond market, yields have fallen sharply across maturities, with two-year Canadian government bond yields reaching their lowest levels since September. This decline reflects market expectations of continued monetary easing and has implications for both investors and the cost of borrowing for businesses and households.

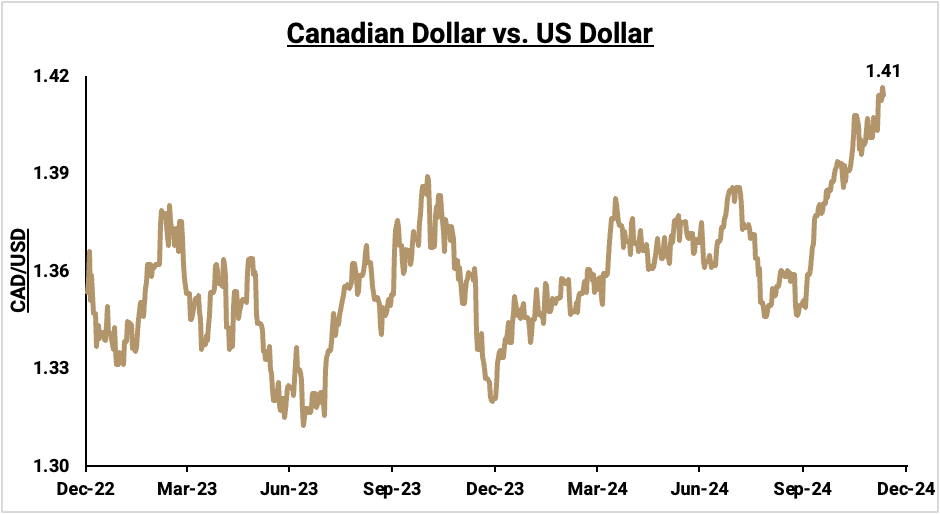

Currency markets have also reacted strongly to the Bank’s actions. The Canadian dollar has continued to weaken significantly against its U.S. counterpart, nearing its lowest level since April 2020. While this depreciation improves the competitiveness of Canadian exports, it raises the cost of imports, adding potential inflationary pressures for consumer goods. The currency’s weakness also complicates policymaking, as the Bank must balance the benefits of a weaker dollar with the risks of excessive depreciation.

Source: S&P Capital IQ

For households, the rate cuts have translated into lower borrowing costs, providing relief for those with variable-rate mortgages or other forms of debt. However, the broader economic slowdown dampened consumer confidence, limiting the immediate boost to spending. In the housing market, reduced mortgage rates reignited demand, raising concerns about affordability and speculative activity in key markets.

Businesses, particularly in export-oriented sectors, benefited from the weaker currency and lower financing costs. However, the uncertainty surrounding trade policies and geopolitical risks, including potential U.S. tariffs on Canadian imports, tempered corporate investment and expansion plans.

Broader Implications for Economic Policy

The Bank of Canada’s aggressive easing highlights its resolve to address economic challenges but also raises concerns about potential risks. One critical consideration is the impact of monetary easing on household debt levels. During the pandemic and the years preceding it, low interest rates fueled rapid increases in household borrowing, particularly in the housing market. While the current round of rate cuts aims to stimulate growth, it also risks reigniting speculative activity and reversing progress made in deleveraging.

External factors further complicate the outlook for monetary policy. Developments in the United States, including the Federal Reserve’s monetary stance and the potential imposition of tariffs on Canadian imports, add layers of uncertainty. The Bank of Canada must also contend with global economic conditions, including slowing growth in major trading partners and fluctuations in commodity prices, which remain critical to Canada’s export-driven economy.

Investment Implications and Strategic Considerations

For investors, the Bank of Canada’s rate cuts present both opportunities and challenges. Equity markets stand to benefit as lower interest rates improve corporate profitability and economic activity. Sectors such as housing, construction, and consumer discretionary are likely to see the most immediate gains, as reduced borrowing costs spur demand. However, the weakening Canadian dollar adds complexity, favoring export-oriented companies while increasing costs for businesses reliant on imported goods.

Fixed-income investors face a more challenging environment as declining yields compress returns on government bonds and other fixed-income securities. This dynamic necessitates a reassessment of risk-return trade-offs and may drive investors toward higher-yielding assets, such as corporate bonds or international markets.

Currency fluctuations also play a crucial role in shaping investment strategies. The Canadian dollar’s depreciation enhances the appeal of export-driven industries but poses risks for portfolios exposed to exchange rate volatility. Diversification and active management will be essential for navigating this shifting landscape.

The Road Ahead

As Canada enters 2025, the effectiveness of the Bank of Canada’s rate cuts will hinge on the economy’s ability to respond to looser financial conditions. Early signs suggest that while the policy moves have alleviated some immediate pressures, significant challenges remain. Consumer confidence, business investment, and external trade dynamics will all play critical roles in determining the success of the Bank’s strategy.

Policymakers must also prepare for the potential need to recalibrate their approach. If inflation remains subdued and growth struggles to gain traction, additional rate cuts may be warranted. Conversely, if the economy shows signs of overheating or financial stability risks emerge, the Bank may need to pause or reverse its easing cycle.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.