Informational Report Revolve Renewable Power (TSXV: REVV | OTCQB: REVVF) April 2025

1. Summary

- Current Price: CAD $0.20 (March 27, 2025)

- Market Cap: CAD $12.6M (March 27, 2025)

- Sector: Renewable Energy | Sub-sector: Utility-Scale & Distributed Generation

- Key Catalysts: M&A-driven expansion, project milestones, recurring revenue growth

Thesis Summary

Revolve Renewable Power Corp (TSXV: REVV) is a renewable energy platform operating across Canada, the U.S., and Mexico, leveraging a hybrid model of utility-scale development (USD) and operating distributed generation (DG) projects. It has proven this model through the strategic sale of 1,550MW of projects to date including the sale of 1,250MW to ENGIE in 2023 with $45M-$55M in remaining proceeds, which will bolster its financial position. In addition, it currently owns and operates 12 megawatts (MW) of net generating capacity benefiting from long term power purchase agreements combined with an 728MW pipeline and favourable domestic energy trends in North America.

2. Company Overview

Business Model & Revenue Streams

Revolve’s business model is uniquely structured to maximize scalability, revenue diversification, and risk mitigation, making it theoretically superior to traditional renewable energy development models. Unlike competitors that focus solely on large-scale project development or single-market operations, Revolve leverages a three-pillar approach that combines Utility-Scale Development (USD) with Distributed Generation (DG), all underpinned by a robust M&A framework. Revolve has a track record of success in all three areas, creating a platform for future growth.

- Develop & Sell Strategy (50MW+): Revolve develops large utility scale projects from greenfield to ready to build, at which point it sells the development rights to large utilities and independent power producers. It has completed the sale of four projects to date for a total of 1,550MW to global utilities such as ENGIE and Enel Green Power. The ENGIE transaction consisted of Revolve Renewable Power selling two utility-scale solar and storage projects, the 1,000MW Bouse Solar and Storage Project and the 250MW Parker Solar and Storage Project, to ENGIE S.A. for a total consideration within the company's guidance range for such assets of US$40-50k per MW. The transaction demonstrates its ability to execute high-value deals, expected to unlock $45M-$55M in remaining proceeds. Revolve currently has a development portfolio of 588MW where it will look to execute a similar monetisation strategy over the coming years. The company plans to partner or sell an additional 500MW from its current development portfolio in 2025, providing significant near- term revenue potential. This pillar delivers high-value, one-time revenue injections.

- Develop & Hold Strategy (Under 50MW): The second part of Revolve’s strategy is to develop, build, own and operate smaller utility scale projects (under 50MW’s) as well as distribution generation projects. Revolve currently owns and operates a net 12MW of generation capacity from a portfolio of wind, rooftop solar, battery storage and combined heat and power projects selling electricity to utilities, municipalities and industrial customers. These projects generate long term recurring revenue based on fixed electricity prices over 10-15 year contract terms. In addition to the Company’s operating portfolio, Revolve has several late-stage projects that it plans to construct, own and operate:

- Three utility scale projects at an advanced stage of development in the US & Canada for a total capacity of 85MW, which it expects to have ready to build in the next 12 months and,

- A distributed generation development portfolio of 140MW of new project opportunities with industrial customers.

This strategy of Develop and Hold delivers long term stable recurring revenue to supplement the large milestone revenues received from the Develop and Sell model.

3. M&A & Expansion Strategy:

Revolve accelerates growth through strategic acquisitions of operational assets. Recent successes include:

- Centrica’s Mexican DG business (August 2022), enhancing DG capabilities.

- Windriver Power Corporation (February 2024), a Canadian renewable operator and developer.

- Bright Meadows solar project (October 2024), 15.7MW and up to 30MW development stageasset in Alberta.

These successes validate Revolve’s strategy of targeting undervalued or operational projects, integrating them into its hybrid USD-DG model, and rapidly monetizing them.

Future M&A will target operating assets in key markets (U.S., Canada) to boost recurring revenue from DG and strengthen the utility-scale pipeline. This pillar generates immediate cash flow, diversifies the portfolio, and reduces reliance on greenfield development.

4. Diversification Strategy: Risk Mitigation & Market Adaptability

Unlike many renewable energy companies that rely solely on a single type of project, Revolve diversifies across:

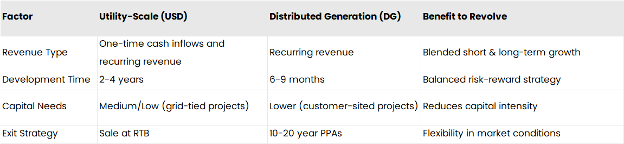

A) Project Type Diversification (USD + DG)

B) Geographic Diversification: U.S., Canada & Mexico

- U.S. (Key Growth Market) → 70MW RTB in 2025.

- Canada (Established Presence) → 15MW solar project RTB in 2025.

- Mexico (Emerging Market Opportunity) → 503.4MW wind projects in progress.

- Why This Approach is Superior:

- Reduces country-specific regulatory risk (e.g., tax policy changes).

- Accesses different incentive structures, improving financial efficiency.

- Balances market cycles – U.S. and Canada offer stability, Mexico offers high-growthpotential.

C) Revenue Stream Diversification: One-Time Sales + Long-Term Recurring Income

Many traditional developers rely exclusively on one-time project sales, creating revenue volatility.

Revolve’s hybrid revenue model ensures financial resilience:

Utility-Scale Development (USD) = Large capital inflows (lump-sum gains from RTB sales). Distributed Generation (DG) = Recurring revenue stream (10–20 year PPAs).

This reduces reliance on external financing and enhances long-term valuation stability.

Capital Efficiency & Faster Monetization Cycles

Compared to large-scale renewable developers, Revolve has a capital-efficient model with faster monetization cycles, meaning:

- USD projects achieve exit faster than constructing/owning large-scale 100MW+ projects, freeing up capital.

- DG projects generate revenue in under 12 months, keeping cash flow positive.

- The Hybrid model reduces the need for frequent dilutive equity raises.

Competitor Weaknesses:

- Mega-project developers (e.g., Ørsted, NextEra) have longer, costlier development cycles.

- Companies reliant on pure project sales have higher earnings volatility.

o Firms without recurring revenue streams struggle with market downturns.

Revolve’s Edge:

- Shorter development timelines → Faster cash generation.

- Flexible capital deployment → Self-funding from USD sales, DG investments and acquisitions.

- Lower capital intensity → Higher return on invested capital (ROIC).

Ability to Capitalize on Growing Demand from AI, Data Centers & Electrification

AI-driven data centers and electrification efforts are driving exponential electricity demand, especially for:

- On-site renewable solutions (DG) for corporate facilities & manufacturing plants.

- Reliable, scalable energy sources (USD) for utilities adapting to higher power loads.

Market Shift Benefiting Revolve:

- Tech giants (Amazon, Google, Microsoft) are buying record-high PPAs.

- Data centers require 3-5x more energy than traditional commercial buildings.

- Companies need fast, flexible solutions → Favoring mid-sized USD & DG projects over mega-projects.

Revolve’s Strategy is Well-Aligned:

- DG projects offer tailored on-site solutions for corporate clients.

- USD projects provide mid-sized, rapidly deployable capacity for utilities & grid operators.

- The ability to scale in both segments ensures maximum exposure to new energy demand.

M&A & Expansion Strategy: De-Risking Growth Through Strategic Acquisitions

Revolve’s history of acquiring and integrating operational renewable assets gives it a competitive advantage over pure-play developers.

Recent M&A Successes & Growth Plans:

- ENGIE transaction (1,250MW sold) → Proof of monetization ability.

- Expansion via additional DG acquisitions → Strengthening recurring revenue base.

- Future M&A focus on operating assets → Immediate cash flow generation.

Why This Approach Works:

- M&A accelerates revenue & cash flow growth without starting from nothing.

- Reduces reliance on new project development, balancing risk exposure.

- Increases operational efficiency by integrating mature assets into the portfolio.

Industry & Market Opportunity

Global Renewable Energy Market Overview

Renewables will exceed 50% of global electricity by 2030 (from 29% today) [Source: IEA World Energy Outlook, 2024], with $1.5 trillion in investments projected by 2035 [Source: BloombergNEF, 2024]. AI and electrification drive demand.

Government Policies and Incentives

Government initiatives and regulatory support are playing a pivotal role in accelerating the transition to renewable energy. These policies provide tax credits, grants, and financing opportunities that significantly reduce project costs and enhance the return on investment for renewable energy companies.

Canada’s Clean Energy Plan — Federal Support for Renewables and Storage

[Source: Canada Budget 2023]

Canada has committed to achieving net-zero emissions by 2050, with interim targets set for 2030 under its Clean Energy Investment Plan.

The plan includes:

- Investment Tax Credits (ITCs) for Clean Energy:

- 30% ITC for clean electricity generation (wind, solar, hydro, nuclear).

- 15% ITC for battery storage and grid modernization projects.

- $15 Billion Canada Growth Fund (CGF):

Supports low-carbon infrastructure investments, encouraging private capital to fund clean energy projects. - Carbon Pricing and Clean Energy Incentives:

Canada maintains one of the world’s most stringent carbon pricing systems, pushing companies toward renewables by increasing the cost of carbon-intensive energy sources. - Provincial Support:

- Alberta & British Columbia: Strong wind and solar growth, alongside corporate PPA expansion, are driving renewable energy adoption. In British Columbia, BC Hydro recently issued a Request for Offers (RFO) for 1,000 MW of new renewable energy capacity, with additional RFPs anticipated in the coming years to meet growing demand and support the province's clean energy goals. This positions BC as a key market for developers like Revolve to expand their hydro project pipeline.

- Ontario: The phase-out of gas-fired power plants has accelerated solar and storage deployment, creating opportunities for distributed generation projects.

These measures collectively reduce financing costs, de-risk investments, and enhance project economics for renewable energy developers like Revolve, particularly in high-growth regions like British Columbia.

U.S. Overall Electricity Demand Growth from Government’s Policy to Reindustrialize the U.S. Manufacturing Base

The U.S. government's policy to reindustrialize the manufacturing base is expected to fuel a surge in domestic production, particularly in energy-intensive industries like steel, chemicals, and electronics. Through initiatives such as the Infrastructure Investment and Jobs Act and the CHIPS and Science Act, new manufacturing facilities are being built, and existing ones are expanding. These developments are driving a significant increase in electricity demand as they require substantial power to operate. This growing energy need highlights the strong connection between industrial revitalization and rising electricity consumption across the U.S.

Inflation Reduction Act (IRA) - 10 year Tax Credit

The Inflation Reduction Act (IRA), signed into law in August 2022, is the largest-ever climate investment in U.S. history, allocating $369 billion in energy security and climate-related programs. The IRA provides long-term investment certainty through:

- Production Tax Credit (PTC): Extends 10-year tax credits for wind, solar, geothermal, and other qualifying renewable projects.

- Investment Tax Credit (ITC): Provides up to 30% credit for clean energy projects, plus additional 10% bonuses for projects in energy communities.

- Direct Pay and Transferability: Allows tax-exempt entities (e.g., municipalities) to receive direct payments instead of tax credits, making project financing more attractive.

- Clean Energy Manufacturing and Supply Chains: Over $60 billion allocated to domestic clean energy manufacturing, strengthening supply chain resilience.

The IRA is expected to double U.S. renewable energy capacity by 2035, providing a long-term demand driver for both utility-scale and distributed generation projects.

Mexico’s Renewable Transition — 30GW Additional Capacity by 2030

Source: Mexico Energy Ministry Plan, 2023

Mexico is undergoing a significant energy transition, driven by a combination of policy shifts and increasing corporate demand for clean energy, as outlined in the Mexico Energy Ministry Plan of 2023. The country has set an ambitious target to install 30GW of new renewable capacity by 2030, reflecting a strategic push to diversify its energy mix and reduce reliance on fossil fuels, which currently dominate its electricity generation.

This goal is supported by several key initiatives:

- Long-term electricity auctions have been implemented to promote competitive clean energy procurement, encouraging private investment in renewable projects by providing a transparent and predictable framework for developers to secure power purchase agreements (PPAs).

- Mexico offers specific incentives for wind and solar development, capitalizing on its strategic geographical advantages—such as high solar radiation averaging 6.3 kWh/m²/day in regions like the northwest (one of the most solar-rich areas globally), and strong wind potential in regions like Oaxaca, home to some of the largest wind farms in Latin America.

- The Comisión Federal de Electricidad (CFE), Mexico’s state-owned utility, is heavily investing in grid modernization. Plans include upgrading transmission infrastructure to support large-scale renewable integration and address historical bottlenecks. Public data shows that the CFE aims to invest over MXN 100 billion (approx. USD $5 billion) by 2030 to expand and modernize the national grid—building new transmission lines and substations to connect remote renewable projects with urban demand centers.

- Mexico’s commitment to reaching 35% clean energy in its electricity mix by 2024 (a target extended into the 2030 plan), along with growing corporate demand for renewables—evidenced by companies like Amazon and Cemex signing large-scale PPAs—creates a favorable environment for further growth.

This transition positions Revolve’s 503MW wind pipeline in Mexico, including projects like El 24 (103.4MW) and Presa Nueva (400MW), as a valuable asset in a rapidly growing market. Wind power is expected to significantly contribute to the 30GW target, with Oaxaca and other regions projected to add 5–7GW of new wind capacity by 2030.

Corporate Demand for Clean Energy

Private-sector demand is becoming a primary driver of renewable energy growth. Large corporations are investing in direct Power Purchase Agreements (PPAs) and on-site renewable generation to meet sustainability goals.

100GW+ of Corporate PPAs Signed Since 2020

The corporate renewable energy market has seen exponential growth, with over 100GW of PPAs signed since 2020, with Amazon securing 28GW, a trend expected to boost demand for Revolve’s projects and set new records.

Key trends include:

- 2023 Record PPA Growth: Over 37GW of new corporate PPAs were signed globally in 2023, with the U.S. accounting for 24GW.

- Sector Leaders:

- Tech firms (Amazon, Microsoft, Google, Meta) leading purchases.

- Retail & manufacturing companies (Walmart, PepsiCo, Ford) expanding commitments.

- Emerging Distributed Generation (DG) Market:

- Smaller-scale PPAs (sub-5MW projects) are gaining traction among commercial and industrial(C&I) clients.

- On-site generation with battery storage becoming standard for energy-intensive facilities.

Large Tech Firms (Amazon, Google, Microsoft) Committing 100% Renewables

Big tech companies have become the largest buyers of renewable energy, using PPAs to power data centers, cloud computing, and AI operations.

- Amazon: World’s largest corporate renewable energy buyer, with 28GW of wind & solar projects secured.

- Google: Carbon-free energy target of 100% by 2030, investing heavily in utility-scale solar & battery storage.

- Microsoft: Targeting carbon-negative operations by 2030; major solar & wind power investments.

- Revolve’s Management has undertaken a strategic initiative to actively target C&I clients.

As AI-driven data center demand surges, tech firms are increasing renewable energy procurement, boosting demand for Revolve’s mid-sized and distributed generation projects.

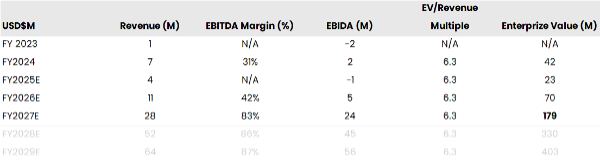

Financial Analysis & Valuation

Pipeline Projects and Revenues

Revolve Renewable Power’s project pipeline is a key driver of its growth strategy, encompassing both Utility-Scale Development (USD) and Distributed Generation (DG) projects across the U.S., Canada, and Mexico. The company’s active development pipeline totals 728.4MW, reflecting projects at various stages of development, from early-stage to those nearing Ready-to-Build (RTB) status.

Pipeline Overview

The development pipeline of 728.4MW is composed of:

- Distributed Generation (DG) Pipeline: 140MWThe DG pipeline consists of sub-5MW projects, including rooftop solar, battery storage, combined heat and power (CHP), and solar thermal solutions, primarily targeting commercial and industrial (C&I) customers in the U.S., Mexico, and Canada. The portfolio is diversified by technology, with approximately 32% rooftop solar, 39% battery storage, 17% CHP, 11% solar thermal, and 21% solar PV. These projects are typically developed under 10-20 year Power Purchase Agreements (PPAs), providing stable, recurring revenue.

- Utility-Scale Development (USD) Pipeline: 588.4MW

The USD pipeline includes projects nearing RTB status or in advanced stages of development, totaling 588.4MW. This comprises: - U.S. and Canada: 85MW, including 70MW of Battery Energy Storage Systems (BESS) and Wind projects in the U.S. (Vernal BESS and Primus Wind) and 15.7MW of solar in Canada (Bright Meadows Solar).

- Mexico: 503.4MW, consisting of the 103.4MW El 24 wind project and the 400MW Presa Nueva wind project.

Revenue Potential from the Pipeline

The 728.4MW pipeline is expected to drive significant revenue growth through a combination of one-time sales from USD projects and recurring revenue from DG projects:

Distributed Generation (DG) Revenue:

- Current Revenue: The existing 5.7MW operational DG portfolio generates approximately $500K annually from electricity sales and financing income, based on quarterly figures of $130K.

- Pipeline Revenue Potential: Deploying 10MW of new rooftop solar projects could add $2.5M in recurring revenue and $2M in EBITDA annually. Scaling this to the 140MW DG pipeline, assuming similar economics, the potential annual revenue could reach $35M, with EBITDA of $28M.

- Timeline: Active development of DG projects in the U.S., Canada and Mexico targets construction starts in 2025, with revenue realization expected to begin in 2026. Increasing momentum in converting the DG pipeline includes letters of intent for a 10MWh BESS project expected to be signed by year-end 2025, and further LOIs issued for additional capacity.

Utility-Scale Development (USD) Revenue:

- Historical Revenue: The sale of the 1,250MW Bouse and Parker projects to ENGIE in January 2023 yielded total consideration of $50M to $62.5M ($40-50k per MW). To date, $6.25M has been received, with $45M-$55M in remaining proceeds.

- Pipeline Revenue Potential: The 588.4MW USD pipeline could generate similar proceeds if sold at

RTB:

- At $40k per MW: $23.5M.

- At $50k per MW: $29.4M.

- Total Potential: $23.5M to $29.4M in one-time revenue.

- Timeline: The 70MW U.S. projects (Vernal BESS and Primus Wind), 15.7MW Canadian project (Bright Meadows Solar), and 503.4MW Mexico projects (El 24 and Presa Nueva) are targeted to reach RTB status in 2025-2026. Sales or partnerships for these projects are being considered, potentially yielding revenue in 2025-2026.

Key Milestones and Catalysts

- DG Portfolio Expansion: Continued growth opportunities in the 140MW DG pipeline, with 10MW of new rooftop solar projects expected to add significant recurring revenue. Construction of DG projects in the U.S. and Canada is targeted to start in 2025-2026.

- USD Projects Nearing RTB:

U.S.: 70MW (Vernal BESS and Primus Wind) targeting RTB in 2025-2026.

Canada: 15.7MW Bright Meadows Solar targeting RTB in 2025-2026.

Mexico: 503.4MW (El 24: 103.4MW, Presa Nueva: 400MW) targeting RTB in 2025-2026, with potential partnership or sale.

- ENGIE Sale Proceeds: $45M-$55M in remaining proceeds from the 1,250MW ENGIE sale, tied to project milestones.

Revenue Summary

- Near-Term (2025-2026): Continued DG revenue from the existing 5.7MW operational portfolio (~$500K annually), plus potential ENGIE milestone payments ($45M-$55M).

- Medium-Term (2026-2027): USD sales from the 588.4MW pipeline ($23.5M-$29.4M) and initial DG project completions (e.g., 10MW adding $2.5M annually).

- Long-Term (2027-2029): Full deployment of the 140MW DG pipeline, potentially generating $35M in annual recurring revenue and $28M in EBITDA.This pipeline positions Revolve to achieve a balanced revenue stream, combining high-margin, one-time USD sales with stable, long-term DG income, supporting its growth trajectory in the renewable energy sector.

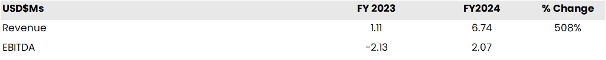

Historical Financial Performance (FY2023-FY2024)

- Revenue surged due to project monetization under Develop & Sell (e.g., ENGIE proceeds) and electricity generation growth from Develop & Hold. Strong gross margins from long-term PPAs and asset sales further bolstered performance.

- Projections are supported by Revolve’s 728MW pipeline, its hybrid model of high-margin RTB sales and stable DG PPAs, and favorable market trends like increasing corporate PPA demand. Revolve’s faster project timelines, proven execution through the ENGIE transaction, and alignment with regulatory incentives like the U.S. Inflation Reduction Act and Mexico’s 30GW renewable target further validate these projections.Projected Financial Performance (FY2025E-FY2029E)

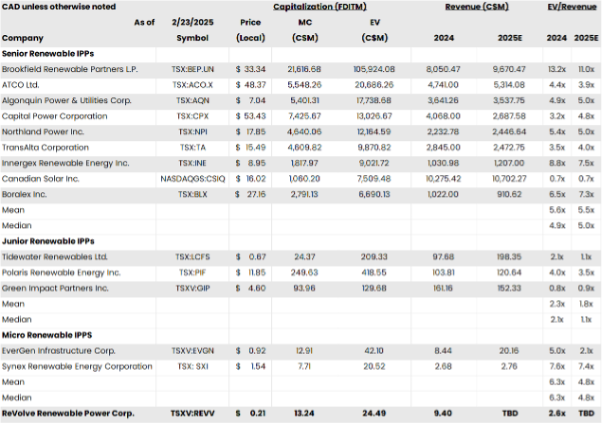

Valuation and Peer Benchmarking

Revolve is positioned for significant growth, and its valuation can be contextualized through recent public-to-private transactions in Canada’s renewable energy sector—specifically involving UGE International Ltd. and Innergex Renewable Energy Inc. UGE International Ltd. was taken private by NOVA Infrastructure Fund II LP, with the transaction closing on August 16, 2024. Innergex entered into a definitive agreement to be acquired by CDPQ on February 24, 2025.

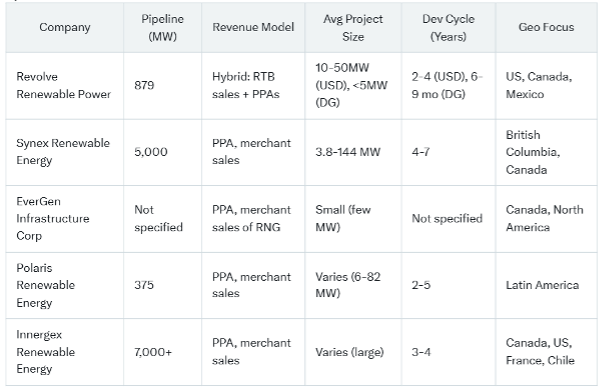

Competitive Landscape

Revolve Renewable Power operates in the mid-sized renewable energy development and distributed generation (DG) space, competing with a mix of focused developers and diversified players across North America. Below, we benchmark Revolve against four key competitors—Synex Renewable Energy Corporation, EverGen Infrastructure Corp, Polaris Renewable Energy Inc., and Innergex Renewable Energy Inc.—to assess its positioning based on pipeline size, revenue model, project timelines, and valuation metrics.

Competitor Profiles

- Synex Renewable Energy (TSX: SXI):

Pipeline of 5,000 MW, including 12 MW operational hydro, 9.4 MW construction-ready run-of-river, 150 MW potential hydro sites, and 4,850 MW wind development sites, as per their strategic review announcement. Revenue model includes PPAs and merchant sales, with projects like the Mears Creek Plant under a 20-year EPA. Average project size ranges from 3.8 MW (Mears Creek) to 144 MW (Bouleau Mountain Wind Project). Development cycle is 4–7 years, based on the Bouleau Mountain Wind Project timeline. Geographical focus: British Columbia, Canada. - EverGen Infrastructure Corp (TSX: EVGN):

Pipeline not specified in available documents; the report’s 600 MW mixed renewables figure lacks confirmation, as EverGen focuses on RNG projects like Fraser Valley Biogas (FWB), which produces 1.2 million cubic feet per day (approx. 4 MW equivalent). Revenue model includes PPAs and merchant sales of RNG, with reported revenues of $3.6 million in Q3 2024. Average project size is small, around a few MW each. Development cycle is not specified due to variability in RNG timelines. Geographical focus: Canada and North America, starting on the West Coast in British Columbia. - Polaris Renewable Energy:

Pipeline updated to 375 MW, with PPAs in Latin America. Project sizes vary from 6–82 MW. - Innergex Renewable Energy:

Pipeline exceeds 7,000 MW, with PPAs across multiple regions. Development cycles range from 3–4 years.

Revolve’s Differentiation

- M&A-Driven Growth: A Strategic Advantage Over PeersRevolve’s acquisition strategy is a standout feature, accelerating revenue and cash flow growth in ways competitors struggle to replicate. The ENGIE transaction (1,250MW sold) exemplifies its ability to acquire, optimize, and monetize assets, yielding $45M-$55M in near-term proceeds and proving its execution prowess. Unlike competitors which rely heavily on organic development, Revolve targets operating assets or late-stage projects, integrating them into its USD and DG portfolios. This approach reduces development risk, shortens timelines, and boosts cash flow—e.g., future M&A in DG could add 50-75MW of operational capacity by 2026, generating CAD $5M-$10M in annual recurring revenue at $0.10/kWh. In contrast, competitor’s slower, organic growth leaves them exposed to longer cycles and higher capital demands.

- Faster Project Development Cycles

Revolve’s 2-4 year USD and 6-9 month DG timelines outpace competitors, with M&A further compressing cash generation timelines (e.g., 70MW U.S. RTB in 2025). - Hybrid Developer-Owner Model

Revolve captures high-margin RTB sales (USD) and stable recurring revenue (DG), a balance enhanced by M&A-sourced assets that peers lack.

Revolve stands out for its speed, flexibility, and hybrid revenue, offering a higher growth profile and better ROIC than peers. However, its smaller scale and reliance on execution (e.g., Mexico’s 503MW wind) require close monitoring against larger, more established competitors.

Key Growth Catalysts

- Develop & Sell: Planned sale or partnership for 500MW in 2025, with $45M-$55M in remaining ENGIE proceeds.

- Develop & Hold: 85MW of late-stage projects reaching RTB in 12 months; 140MW of DG opportunities targeting industrial clients.

- M&A: Continued acquisitions of operational assets to boost recurring revenue and expand the pipeline.

Risks & Mitigation Strategy

Key Risks

The renewable energy sector is dynamic but not without challenges. Below, we expand on Revolve’s risks with industry-specific depth and quantify their potential impact where possible.

- Regulatory Uncertainty:

U.S.: Changes to Inflation Reduction Act tax credits (e.g., post-2032 expiration) could reduce USD project economics by 20-30%.

Canada: Shifts in provincial policies (e.g., Alberta’s wind moratorium debates) may delay 15MW solar RTB.

Mexico: Political instability and CFE grid bottlenecks threaten the 503.4MW wind pipeline—delays could cut projected revenue by CAD $50M-$70M over 5 years. - Financing Risks:

Rising interest rates (e.g., U.S. Fed funds at 4-5% in 2025) increase debt costs for Revolve’s USD projects. A 1% rate hike would raise financing costs although the current debt burden is expected to be manageable.

DG’s smaller scale may struggle to attract institutional capital compared to Innergex’s mega-projects. - Execution Risks:

Delays in permitting or construction (e.g., 70MW U.S. RTB) could push timelines from 2-4 years to 5+ years, reducing NPV by 15-20%.

Mexico’s grid upgrades lag demand—only 50% of planned transmission capacity may be online by 2027, risking 503MW wind viability.

- Supply Chain Disruptions:

Solar panel shortages or tariff hikes (e.g., U.S.-China trade tensions) could increase DG costs by 10-15%, eroding margins on 140MW pipeline.

Battery storage price volatility (e.g., lithium up 20% in 2024) impacts DG competitiveness for C&I clients. - Competitive Pressure:

Larger peers like Innergex (8,000MW) and Evergen (600MW) may outbid Revolve for corporate PPAs with tech giants, limiting DG growth to 100MW instead of 150MW+.

Sunex’s solar focus could undercut Revolve’s pricing in overlapping U.S./Canada markets.

Mitigation Strategies

- Diversified Portfolio: Spanning U.S., Canada, and Mexico, Revolve hedges regulatory risk—e.g., U.S./Canada’s 85MW RTB in 2025 offsets Mexico delays.

Long-Term PPAs: DG’s 10–20 year contracts lock in CAD $20M-$30M annual revenue at $0.10/kWh, shielding against price volatility. - Local Partnerships: In Mexico, alliances with CFE or private developers could secure grid access, ensuring 50-75% of 503MW comes online by 2028.

- Flexible Sourcing: Multi-supplier contracts for panels and batteries reduce exposure to shortages—e.g., shifting 20% of DG inputs to European vendors if U.S. tariffs rise.

- Niche Focus: Targeting mid-sized USD (10-50MW) and DG (<5MW) avoids direct competition with Innergex’s mega-projects, securing C&I clients like mid-tier manufacturers.

Quantitative Risk Assessment

Base Case: 728MW pipeline delivers cumulative CAD ~$160M revenue and EBITDA CAD ~$128M by 2029. Bear Case: 30% pipeline delay (e.g., Mexico grid issues) cuts cumulative revenue to CAD $112M, reducing EBITDA to CAD $90M

Upside Case: Faster DG execution (200MW vs. 140MW) boosts cumulative revenue to CAD $200M, lifting valuation%.

Conclusion

Revolve’s three-pillar strategy—Develop & Sell, Develop & Hold, and M&A & Expansion uniquely positions the company in the renewable energy sector. This approach drives growth, diversifies revenue, and mitigates risks, offering a compelling opportunity.

Furthermore, the strong financial trajectory with revenue and EBITDA growth & recurring revenue model; multiple near-term catalysts (ENGIE payments, M&A, project milestones) and under valuation vs. peers, presenting an attractive entry point.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.