Infrastructure Expansion for EVs: How Investments in Charging Infrastructure Facilitate the Adoption of EVs in North America

In recent years, electric vehicles (EVs) have taken center stage in North America's political and social landscape. Much of this attention can be traced back to 2014, when Tesla—now a global leader in EV expansion—made all its patents open-source to spur competition and innovation among other automakers. Since then, this decision has had a profound ripple effect across the automotive industry, prompting major players such as General Motors, Ford, and Volkswagen to commit billions of dollars to EV development. Additionally, regulatory shifts have reinforced this momentum, with Canada banning the sale of fuel-powered cars by 2035 and the U.S. government introducing tax and carbon credits for EV buyers and manufacturers through the 2022 Inflation Reduction Act.

However, beyond regulations and incentives, the widespread adoption of EVs heavily depends on the expansion of charging infrastructure. A robust and accessible charging network mitigates range anxiety—the fear of running out of battery without access to a charging station—and reduces the pressure on automakers to produce longer-range EVs. This mutually benefits both manufacturers and consumers, making infrastructure expansion a crucial factor in the industry's long-term success.

As of June 2024, Canada had approximately 22,000 publicly available charging stations, while the United States had 189,000 charging ports across 70,000 locations. A Pew Research Center study from 2023, using data from an independent survey and the U.S. Energy Department’s Alternative Fuels Data Center, found that 64% of Americans live within two miles of a public EV charger, and 39% live within one mile. Compared to gasoline stations, EV charging infrastructure is rapidly catching up, making EVs a more viable option for consumers.

Key Drivers of EV Infrastructure Expansion

The development of EV charging stations is driven by both automakers and independent companies. Tesla’s Supercharger network remains the most extensive in the U.S., with over 2,500 sites and 30,000 stalls, reinforcing Tesla’s dominant market position. Other major automakers, such as General Motors, have also invested in charging infrastructure to support their growing EV lineups.

On the legislative front, the U.S. and Canadian governments have introduced significant incentives to encourage infrastructure growth:

U.S. Investments:

- Since 2020, the Biden administration has prioritized EV infrastructure, setting a national goal of 500,000 charging ports.

- The 2021 Infrastructure Investment and Jobs Act allocated $7.5 billion to EV charging expansion.

- In Q4 2024, the Department of Energy, focusing on independent charging station makers, granted EVgo a $1.25 billion loan to build 7,500 chargers across 1,100 new stations.

- Stellantis and Samsung received preliminary approval for $7.54 billion to construct a battery factory in Indiana.

- Luxury EV manufacturer Rivian secured $6.6 billion to build an EV production plant in Georgia.

Canada’s Investments:

- In September 2022, the Canada Infrastructure Bank (CIB) committed CA$500 million to triple the country’s EV charging network.

- Previous Canadian investments have exceeded CA$7.5 billion, funding 40+ projects nationwide.

- Ontario’s CA$63 million ChargeON program and British Columbia’s Public Charger program are further expanding regional EV infrastructure.

Challenges and Future Outlook

Despite rapid expansion, EV infrastructure comes at a steep cost, not only in initial construction but also in maintenance and depreciation. Critics argue that the financial burden of an EV transition is significant. Montreal-based consultancy firm Dunsky Energy + Climate estimates that Canada’s EV transition alone could cost up to CA$300 billion by 2040.

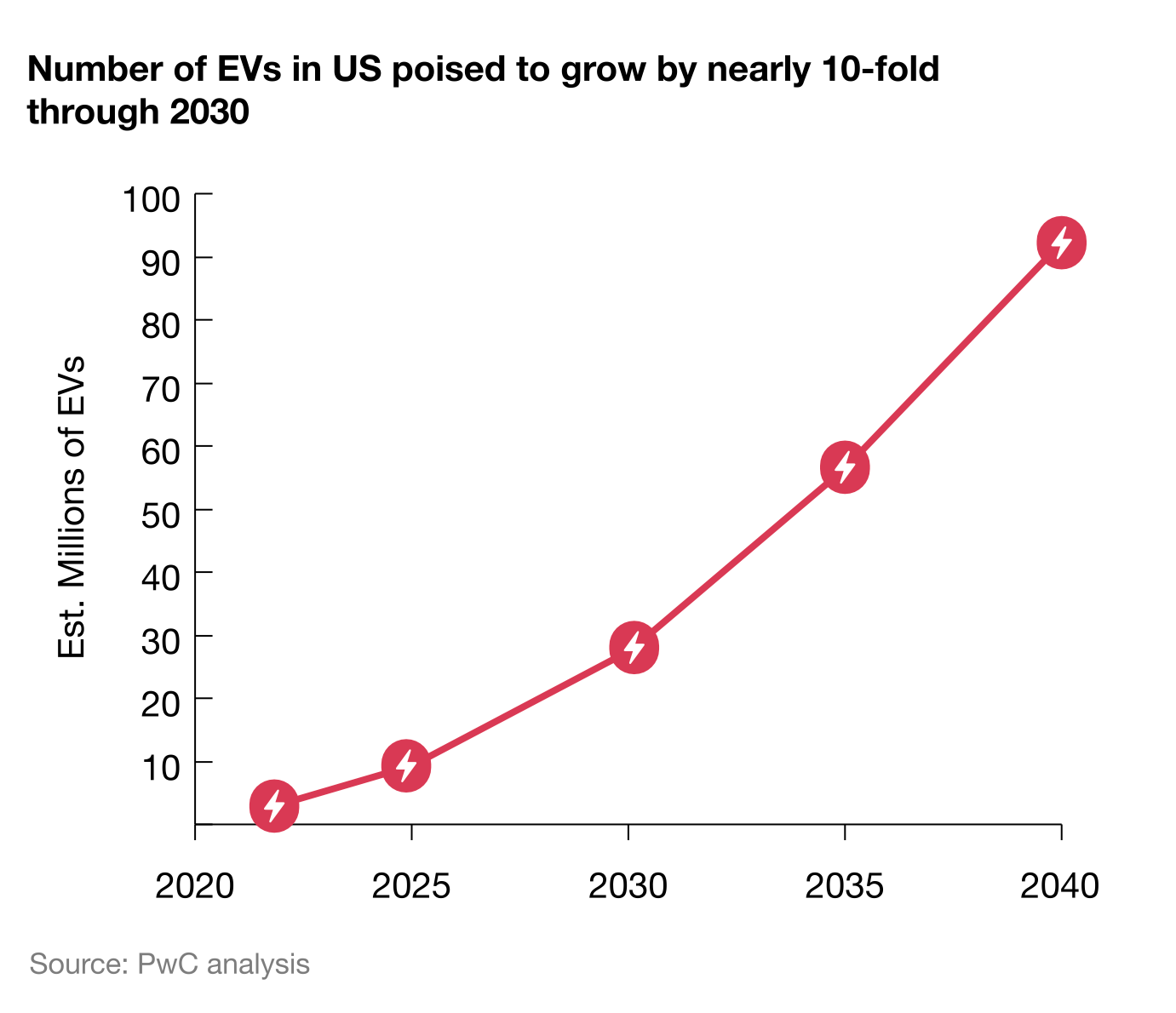

Meanwhile, Analysts at PricewaterhouseCoopers (PwC) predicts exponential growth in EV adoption:

- By 2030, the U.S. will have 27 million EVs on the road, requiring a tenfold increase in charging infrastructure.

- By 2040, an estimated 92 million EVs will be in operation, compared to just 3 million in 2025 (3% of new car sales).

The rapid expansion of EV charging networks, combined with rising EV adoption, underscores the critical role of infrastructure in shaping North America’s transition to clean transportation. While challenges remain, strategic investments and government incentives continue to drive industry momentum.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.