Inside the Pouch Boom: Trends and Insights

Market Drivers and Catalysts

- Declining Vaping Industry: Sales of vaping products have declined significantly due to heightened regulatory scrutiny, public health campaigns, and consumer safety concerns. This shift is propelling growth in nicotine pouches as consumers seek alternative, smoke-free nicotine delivery solutions.

- Health and Wellness Trends: Increasing consumer health consciousness, especially among millennials, fitness enthusiasts, and athletes, is fuelling demand for nutraceutical-infused pouches that offer cognitive, mood, and energy enhancements without respiratory implications.

- Regulatory Environment: Favorable regulatory landscapes for smoke-free alternatives, combined with ongoing restrictive measures against combustible tobacco and vaping products, create substantial tailwinds for pouch products.

The pouch industry which encompasses nicotine and nutraceutical products, has experienced significant growth across various regions. Below is a comprehensive analysis segmented by market size in Canada, the United States, and Europe; leading nicotine brands; top nutraceutical energy and mood brands; opportunities for innovation; and financial summaries of Philip Morris International and Turning Point Brands.

1. Market Size by Region

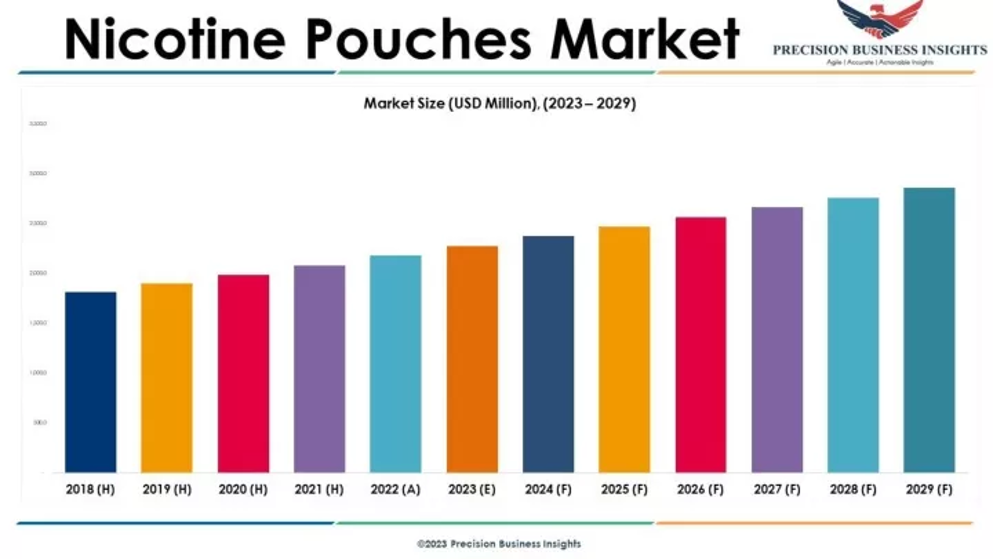

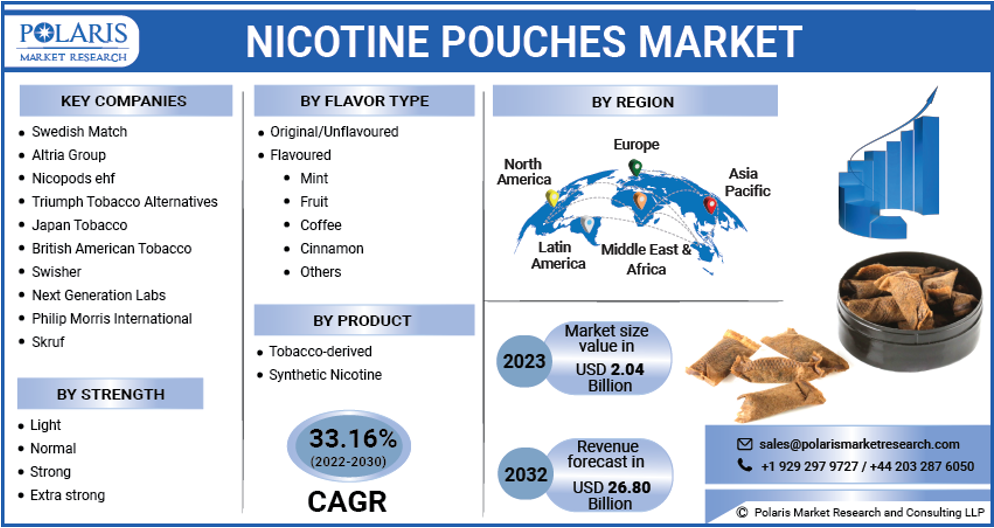

- Global Overview: The global nicotine pouches market was valued at approximately USD 5.39 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 29.6% from 2025 to 2030. grandviewresearch.com

- Europe: Europe holds a significant share, with the market projected to reach USD 5.07 billion by 2030, growing at a CAGR of 29.3% from 2025. grandviewresearch.com

- United States: The U.S. market has seen rapid expansion, with brands like Zyn leading in sales. Investopedia+4Tobacco Reporter -+4Statista+4

- Canada: Specific data for Canada is limited, but the increasing global trend suggests a growing market presence.

2. Top 5 Leading Nicotine Brands

- Zyn: Dominates the U.S. market with a 77% retail value share as of Q3 2023. Tobacco Reporter-

- On!: Holds a 24.6% unit share in the U.S. market. PM

- Velo: Accounts for 12.1% of the U.S. market share. PMC

- Rogue: Maintains a 4.8% share in the U.S. market. annualreports.com

Lyft: Popular in European markets, contributing significantly to the region's sales.

3. Top 10 Nutraceutical Energy and Mood Brands

While specific brand rankings fluctuate, notable products include: Buying Expert+1fortune.com+1

- Moon Juice: Offers supplements like Beauty Dust and Brain Dust, focusing on mood and energy enhancement. morningstar.com+4Buying Expert+4Moon Juice+4

- Nutricost: Provides Rhodiola Rosea supplements known for boosting energy and reducing fatigue. Healthline

- Ginseng Supplements: Widely recognized for enhancing energy and cognitive function. Healthline

- Sage Extracts: Utilized for mood improvement and cognitive benefits.

- Guarana-Based Products: Known for their stimulant properties, aiding energy boosts. Healthline

- Bacopa Monnieri: Supplements aimed at enhancing focus and mental clarity. Buying Expert+3Moon Juice+3fortune.com+3

- Peppermint Extracts: Used for invigorating effects and mental alertness.

- Rhodiola Rosea: Supports energy levels and combats fatigue.

- Ashwagandha Products: Aid in stress reduction and energy enhancement.

- Omega-3 Fatty Acids: Contribute to mood stabilization and overall mental health. fortune.com

Nutraceutical Pouches Are Growing In Popularity

Opportunities for Innovation

- Product Diversification: Developing pouches with varied flavors, nicotine strengths, and functional additives to cater to diverse consumer preferences. cognitivemarketresearch.com

- Health and Wellness Integration: Incorporating vitamins, adaptogens, or nootropics into pouches to appeal to health-conscious consumers seeking mood and energy enhancements.

- Sustainability: Utilizing biodegradable materials for pouch packaging to address environmental concerns and attract eco-conscious customers.

- Technology Integration: Implementing smart packaging with QR codes or apps to provide usage tracking, product information, and personalized recommendations.

- Regulatory Compliance: Staying ahead of evolving regulations by developing products that meet safety standards and transparent labeling requirements.

Innovation and Investment Opportunities

- Ingredient and IP Development: Opportunities exist in the creation of proprietary blends, incorporating functional ingredients such as adaptogens, nootropics, natural stimulants, vitamins, and performance enhancers. Developing unique formulations can establish significant competitive differentiation and intellectual property advantages.

- Sustainability and Packaging: Market potential for companies innovating with sustainable, biodegradable materials and smart packaging technologies that appeal to environmentally conscious consumers. Leveraging eco-friendly packaging solutions can significantly enhance brand value and consumer loyalty.

- Personalization and Consumer Engagement: Innovations in personalized products, subscription models, and digital engagement tools (such as mobile applications and interactive QR codes) can foster deeper consumer connections and brand loyalty.

- Strategic Partnerships and Collaborations: Investment potential exists in strategic collaborations with health and wellness influencers, fitness brands, and sports organizations to boost credibility, visibility, and consumer reach.

The Gradual Decline of Vaping Products

The Decline of Vaping Products and the Rise of Nicotine Pouches

In recent years, the vaping industry has faced significant challenges, including regulatory scrutiny, health concerns, and shifting consumer preferences. These factors have contributed to a notable decline in vaping product sales, creating an opportunity for alternative nicotine delivery systems, particularly nicotine pouches, to gain market share.

Regulatory and Health Concerns Impacting Vaping Sales

Regulatory actions, such as flavor bans and increased scrutiny of e-cigarette products, have played a pivotal role in the decline of vaping sales. For instance, flavor bans at state and federal levels have limited product offerings, reducing consumer appeal. Additionally, the Food and Drug Administration (FDA) has intensified its review process for vaping products, leading to uncertainty in the market. Health concerns, including reports of vaping-related lung illnesses, have further deterred consumers from using e-cigarettes. Tobacco Reporter -

Nicotine Pouches: A Growing Alternative

As vaping products face declining sales, nicotine pouches have emerged as a popular alternative. These products offer a smokeless, discreet, and often flavored nicotine experience, appealing to consumers seeking alternatives to traditional tobacco and vaping products. The convenience and perceived lower health risks associated with nicotine pouches have contributed to their rapid adoption.

Market Trends and Consumer Behavior

The shift from vaping to nicotine pouches reflects changing consumer behavior influenced by health considerations, regulatory environments, and lifestyle preferences. Consumers are increasingly seeking products that align with a smoke-free lifestyle, and nicotine pouches meet this demand by providing a convenient and socially acceptable nicotine delivery method.

The decline in vaping product sales, driven by regulatory challenges and health concerns, has paved the way for nicotine pouches to capture a growing segment of the nicotine market. As consumers continue to seek alternatives to traditional tobacco and vaping products, nicotine pouches are well-positioned to meet this demand, signaling a significant shift in the nicotine delivery landscape.

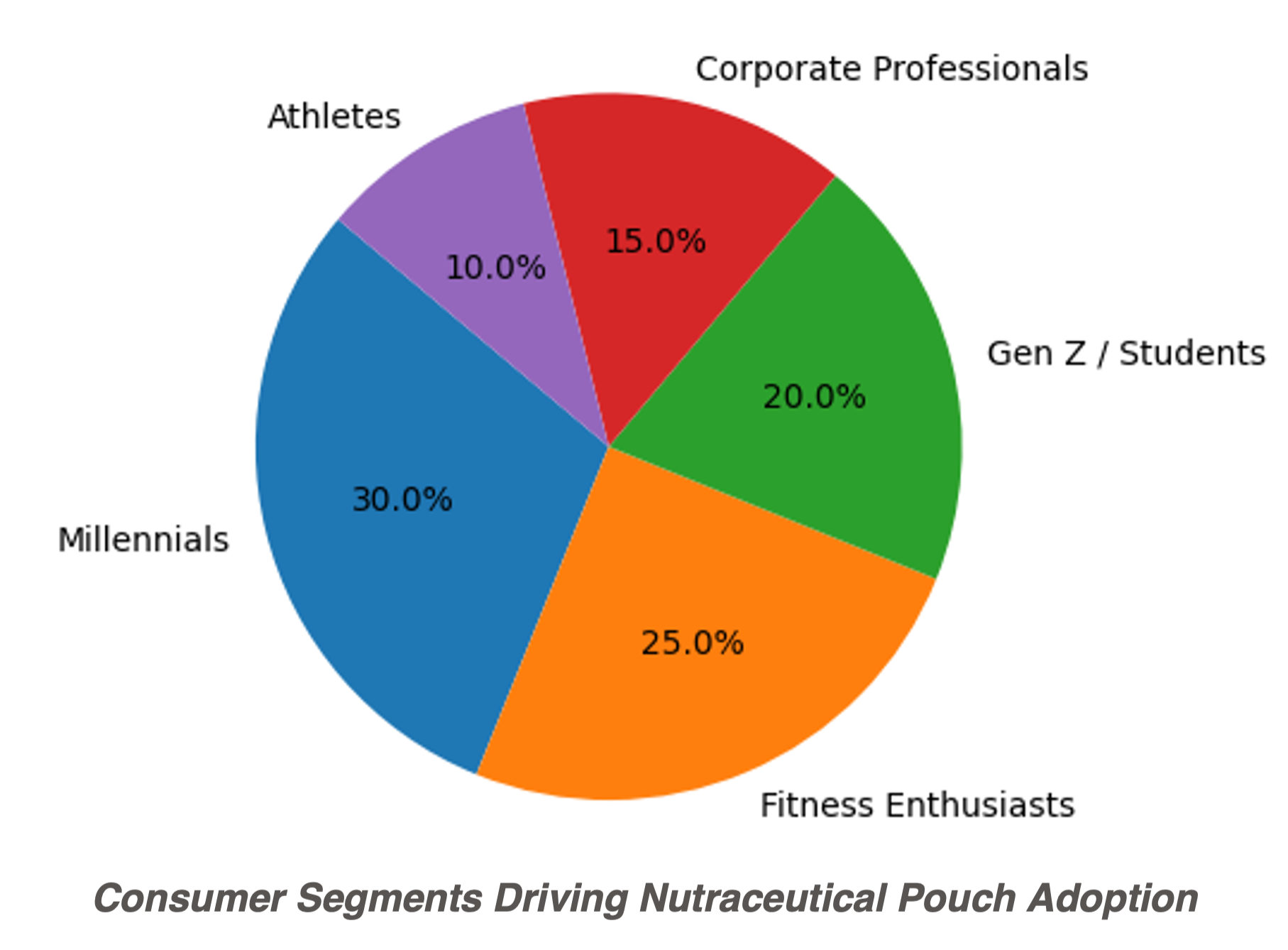

The nicotine pouch market is experiencing significant growth, particularly among millennials, fitness enthusiasts, and athletes. This trend is driven by a combination of health consciousness, lifestyle preferences, and the search for discreet nicotine alternatives. Indiana Daily Student

Vaping Trends Fueling Pouches

Millennials (Ages 27–42)

Profile & Behavior:

- Health-conscious and tech-savvy, millennials often seek alternatives to traditional smoking.

- They value products that align with their lifestyle, including discreet usage and minimal health risks. Latest news & breaking headlines+1Indiana Daily Student+1

- Online platforms are a primary purchasing channel, offering convenience and a wide product selection. market.us

Market Opportunity:

- Developing nicotine pouches with natural ingredients and transparent labeling can appeal to this demographic.

- Offering subscription models and personalized product recommendations can enhance customer loyalty.

Fitness Enthusiasts

Profile & Behavior:

- Individuals focused on physical health often avoid smoking and vaping due to respiratory concerns. PMC

- Nicotine pouches offer a smokeless alternative that doesn't compromise lung function.

- The discreet nature of pouches allows for use without disrupting workout routines. Latest news & breaking headlines+1transparencymarketresearch.com+1

Market Opportunity:

- Introducing pouches infused with energy-boosting ingredients like caffeine or B-vitamins can cater to this group.

Collaborations with fitness influencers can increase brand visibility and credibility.

Athletes – Recreational and Professional

Profile & Behavior:

- Athletes, particularly in team sports, have reported using nicotine for its potential performance-enhancing effects. PMC

- The use of nicotine pouches is prevalent due to their discreetness and lack of respiratory impact.

Market Opportunity:

- Developing products tailored for athletes, focusing on performance and recovery, can meet specific needs.

- Sponsorships and partnerships with sports teams can position the brand within this niche market.

Strategic Insights

- The global nicotine pouch market is projected to grow at a CAGR of 29.6% from 2025 to 2030, reaching USD 25.40 billion by 2030. Grand View Research

- North America holds a significant market share, with the U.S. market expected to witness substantial growth. Grand View Research

- Product innovation, including flavor diversification and functional additives, can drive market expansion.

By understanding the preferences and behaviors of these customer cohorts, companies can tailor their products and marketing strategies to effectively capture and serve these segments.

Nutraceutical Energy Market for Pouches

Why Consumers are Choosing Nutraceutcal Energy Pouches

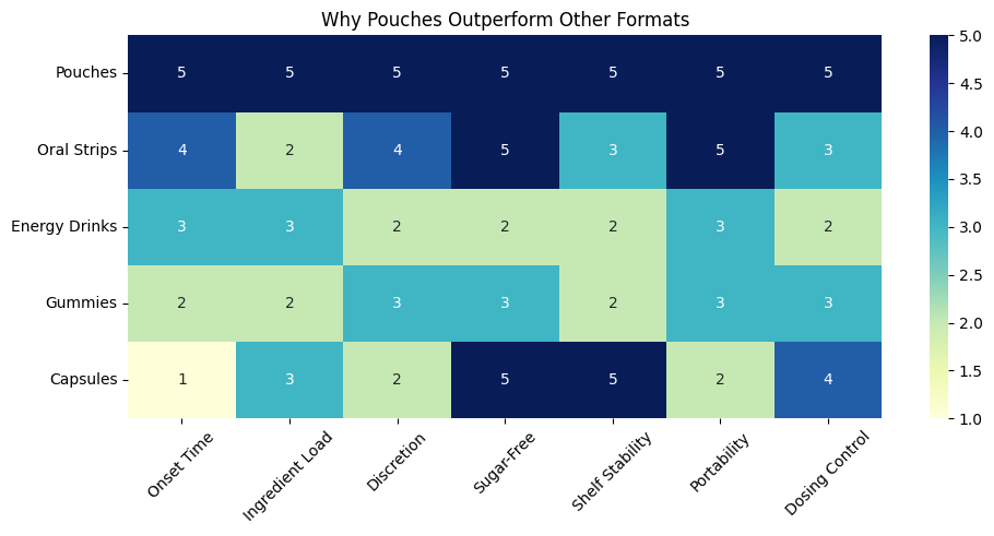

Consumers are increasingly turning to nutraceutical energy pouches as a convenient, efficient, and discreet way to enhance energy, mood, and overall well-being. Unlike traditional energy drinks, these pouches offer a rapid and controlled release of active ingredients without excessive sugar and calories. They align with consumer trends toward health consciousness, convenience, and clean-label ingredients.

Key Players in the Nutraceutical Energy Pouch Market

Several innovative brands are leading the market, including emerging names like Neuro, Rogue Energy, Run Gum, Apollo Energy Gum, and Blockhead Energy. These brands are driving market awareness through targeted marketing, emphasizing functional benefits, natural ingredients, and convenience.

Potential to Replace Traditional Energy Drinks

Nutraceutical energy pouches have the potential to significantly disrupt the traditional energy drink market. They offer the advantages of precise dosing, no liquid spills, convenience in usage, portability, and discreet consumption. Additionally, the absence of sugar crashes associated with many energy drinks makes pouches an appealing alternative.

Advantages Over Strips

While oral strips also provide discreet and rapid absorption, pouches have distinct advantages:

- Extended Release: Pouches typically allow a sustained release of active ingredients, providing consistent energy levels over a longer period.

- Convenience: Easier to manage and use during physical activities or while traveling.

- Taste and Mouthfeel: Pouches offer more pleasant mouthfeel and flavor experiences, increasing consumer preference and repeat usage.

Capacity for Ingredients: Pouches can accommodate larger quantities of active ingredients, making them more effective for functional purposes like energy boosting and mood enhancement.

Strategic Market Positioning

With strong underlying growth drivers, demographic shifts, and increasing regulatory clarity, the global pouch market represents a significant and expanding investment opportunity with robust long-term potential for market participants.

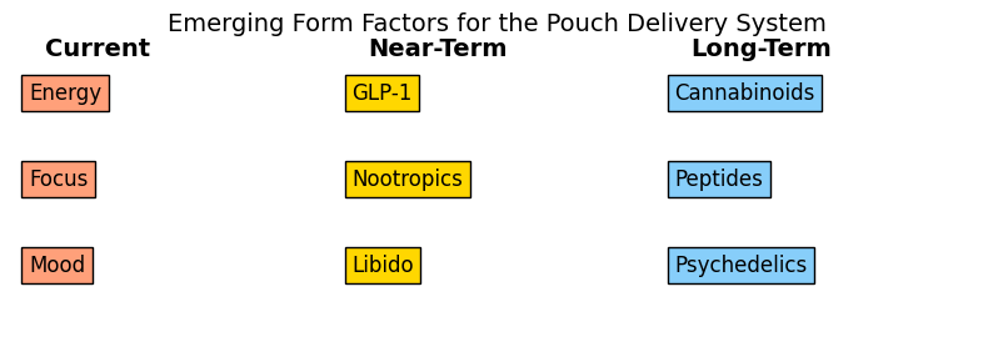

Emerging Factors That Could Enter the Pouch Format

1. GLP-1 Derivatives / Peptide-Based Actives (Rx & Wellness)

- Opportunity: Microdose delivery of GLP-1 analogs or appetite-suppressing compounds in non-injectable formats.

- Innovation Required: Buccal absorption technologies that allow for stable peptide delivery or precursor activities that stimulate GLP-1 production.

- Use Case: Weight management, type 2 diabetes support, metabolic syndrome.

2. Fast-Acting Cognitive & Nootropic Blends

- Ingredients: Alpha GPC, Lion’s Mane, L-Theanine, Citicoline, Rhodiola.

- Why Pouches Work: Steady-release, convenience for on-the-go professionals, students, gamers.

- Differentiator: Cognitive boost without the crash or liquid stimulant.

3. Cannabinoids / Minor Cannabinoids (CBN, CBG, THCV)

- Emerging Trend: Cannabinoid pouches (like how nicotine started) for sleep, pain, focus.

- Challenge: Regulatory and bioavailability optimization for sublingual/buccal formats.

4. Functional Mushrooms

- Examples: Reishi (stress), Cordyceps (energy), Chaga (immunity).

- Why It Works: A clean-label alternative to pills and drinks, pouches allow multi-dose regimens.

5. Oral Antivirals / Immune Boosters

- Examples: Zinc acetate, quercetin, vitamin C, echinacea.

- Rx Angle: Potential for over-the-counter or travel-focused antiviral pouches.

- Timing: Could align with flu season or pandemic preparedness strategies.

6. Anti-Anxiety & Mood Balancing Blends

- Key Ingredients: GABA, Ashwagandha, 5-HTP, L-Tryptophan.

- Application: Travel, flight anxiety, workplace stress.

- Differentiation: Non-sedative formats with daily usage compliance.

7. GLP-1 Enhancers (Non-Peptide-Based)

- Examples: Berberine, chromium picolinate, gymnema sylvestre.

- Why Now: Massive interest in metabolic health—pouches are a discreet, daily delivery vehicle.

8. Sexual Wellness / Testosterone & Libido Boosters

- Ingredients: Yohimbine, Tribulus, Tongkat Ali, DHEA microdoses.

- Use Case: Performance-focused supplements with “social occasion” portability.

- Optional Add-On: “Night pouch” blends with combined relaxation and enhancement.

9. Hangover Recovery & Liver Detox

- Ingredients: N-Acetyl Cysteine (NAC), milk thistle, B vitamins.

- Timing: Marketed for post-night out; huge influencer and lifestyle crossover opportunity.

10. Psychedelic Microdose / Functional Precursors (Future-forward, decriminalized markets)

- Formulations: Microdosed psilocybin analogs, nootropic stacks.

- Status: Early-stage, but aligned with mental health and productivity markets.

R&D Considerations for Form Factor Expansion

- Stability: Ingredient stability in moist environments and long shelf life.

- Absorption: Buccal vs sublingual optimization—must consider bioavailability.

- Dose Control: Ability to deliver accurate and consistent microdoses.

- Regulatory: Some ingredients require GRAS status, DIN/NPN registration, or Rx licensing.

Innovation Pathways in Energy Pouches

Unlocking the Next Frontier in Functional Delivery

1. Smart Dosing & Layered Release

- Multi-phase pouch technology enabling rapid onset followed by sustained delivery

- Ideal for energy, cognition, or weight-loss support

- Creates defensible IP and enhances brand loyalty

2. Personalized Performance Skus

- App-linked or QR-based pouch selection (e.g., Focus, Endurance, Mood Boost)

- Supports DTC models with targeted, high-frequency use cases

- Builds consumer data and loyalty loops

3. Hybrid Functionality (Stacked Benefits)

- Combination actives: Caffeine + L-Theanine, Rhodiola + Vitamin B12, Electrolytes + Adaptogens

- Solves multiple pain points per unit

- Daily use potential for high-retention consumer base

4. Clean Tech & Sustainable Packaging

- Biodegradable pouch fibers, plant-based materials, waterless manufacturing

- Aligns with ESG mandates and drives shelf preference in wellness-forward retailers

5. Enhanced Sensory Experience

- Flavor capsules, cooling agents, or effervescent reactions within pouch

- Elevates user experience beyond traditional delivery systems

- Drives social virality and Gen Z adoption

Disruptive Ingredients for Next-Gen Energy Pouches

From legacy stimulants to globally inspired bioactives

Natural Stimulants

- Guarana – natural sustained caffeine, popular in LATAM

- Yerba Mate – antioxidant-rich clean energy

- Kola Nut – legacy stimulant with cultural edge

Adaptogens & Cognitive Enhancers

- Rhodiola Rosea – physical endurance + stress control

- L-Theanine – smooths caffeine delivery, reduces crash

- Lion’s Mane – cognitive health + mental clarity

Performance Minerals & Nutrients

- Magnesium Bisglycinate – calm energy, muscle recovery

- Vitamin B12 / B6 – essential for metabolism, common deficiency

- Sodium / Potassium Citrate – hydration and energy balance

Global & Emerging Superfoods

- Decocainized Coca Leaf Extract – clean, stimulant-rich IP with virality

- Beetroot Extract – natural nitric oxide booster for endurance

- Gingerol – thermogenic, circulatory stimulant with gut health benefits

GLP-1 Inspired Metabolic Enhancers

- Berberine, Chromium Picolinate, Gymnema Sylvestre

- Mimics metabolic benefits of GLP-1 without prescription

- Targets weight loss and appetite control segments

Strategic Positioning Takeaway:The convergence of wellness, convenience, and disruptive formulation places energy pouches in a high-growth lane—especially as they evolve beyond caffeine into multifunctional, IP-driven delivery vehicles. A small number of institutional-quality brands will define this next wave.

Philip Morris International Inc. (NYSE: PM)

Philip Morris International Inc. (PM) is conducting one of the most ambitious business transformations in the global consumer sector, transitioning from traditional combustibles to a fully smoke-free portfolio. At the center of this pivot is Zyn, the nicotine pouch brand acquired through the $16 billion purchase of Swedish Match, which has rapidly become the crown jewel of PMI’s U.S. growth strategy.

Zyn’s blistering growth trajectory is driving revenue diversification, margin expansion, and an emerging investor re-rating of Philip Morris’ long-term value proposition. The company has demonstrated strong execution in integrating Swedish Match’s operations and is now leveraging its global infrastructure to scale Zyn into key markets. With U.S. pouch volumes inflecting and significant whitespace remaining in international markets, Zyn is poised to become a structural contributor to top-line growth.

We believe institutional investors may be underestimating three key dynamics:

- The lifetime value (LTV) of Zyn users, who demonstrate high stickiness, low churn, and strong pricing tolerance;

- The profitability differential between pouches and combustibles, with Zyn commanding meaningfully higher gross margins;

- And the regulatory tailwind, as policymakers begin to recognize the public health rationale for reduced-risk nicotine alternatives.

The market remains constructive on (i) acceleration in Zyn volumes and operating leverage, (ii) capital deployment toward high-margin, reduced-risk products (RRPs), and (iii) dividend visibility, even amid a declining combustible base. We view PM’s dual strategy—defending legacy cash flows while rapidly scaling next-generation products—as a compelling thesis for long-term capital appreciation and income stability.

Philip Morris is not simply evolving—it is actively redefining its industry positioning, and Zyn represents the sharpest expression of that strategy.

Investment Thesis

- Zyn Is the Next Marlboro: Zyn is now PMI’s fastest-growing product, with volumes up >42% YoY in Q4 2024 and accounting for ~165 million cans shipped in the U.S. alone. This shift is unlocking a long tail of recurring cash flow with unit economics far superior to cigarettes.

- Margin Expansion Story: Zyn has gross profit margins estimated at 80–85%, compared to 10–15% for combustibles. Operating leverage improves with scale, and we expect EBIT margin contribution from Zyn to surpass IQOS by 2026.

- Secular Tailwinds: Health-conscious consumers are accelerating the transition away from smoking and vaping. Zyn is well-positioned to capture this demand shift as both a harm-reduction and lifestyle product. We view nicotine pouches as a structurally growing subcategory with TAM expansion potential from $4B today to $20B+ by 2030.

- Capital Allocation Discipline: PMI is deploying $800M+ to double Zyn production in the U.S., backed by high ROI visibility. Capex is being funded with internal cash flow without compromising the dividend.

- Re-rating Catalyst: The market is beginning to recognize PMI not as a “cigarette company,” but as a consumer health company with proprietary nicotine IP and dominant category positions in multiple smoke-free segments

Financial Performance & Zyn’s Contribution

Metric | Q4 2024 | YoY Change |

Net Revenues | $9.71B | 7.3% |

Adj. EPS | $1.55 | 9.1% |

Zyn Volumes (US) | 165M cans | 42% |

RRPs as % of Revenue | 38% | vs. 32% YoY |

• Zyn’s contribution to U.S. smoke-free revenues grew >55% YoY, now representing over 20% of PMI’s U.S. revenues.

• PMI has guided for 25–30% YoY volume growth in Zyn for FY2025 and reiterated a longer-term goal to derive >66% of total revenues from smoke-free products by 2030.

Turning Point Brands (TPB) is the fourth-largest player in the U.S. smokeless tobacco market, with growing exposure to oral nicotine pouches, the fastest-growing subsegment of the nicotine industry. While the company’s core portfolio includes heritage brands in loose-leaf chewing tobacco, moist snuff, and rolling products, it is TPB’s pivot into modern oral that makes it a compelling asset for either strategic consolidation or investor accumulation.

We view TPB as an under-appreciated consolidation target for international majors like Japan Tobacco (JT) or Imperial Brands, both of which are actively seeking U.S. growth via smoke-free alternatives.

TPB launched FRĒ nicotine pouches, a modern oral brand that has gained meaningful shelf space across convenience and gas channel distribution networks. Despite limited marketing scale versus Swedish Match’s Zyn, FRĒ is estimated to hold 4–5% market share in U.S. pouches, representing real consumer traction in a two-player dominated space.

This would represent a meaningful deviation from JT’s historical strategy of avoiding the U.S. market due to legal risk. Two catalysts have changed JT’s calculus:

1. Stronger Currency Preference – After years of EM currency volatility, JT is attracted to USD-denominated revenues.

2. Litigation Risk Reassessment – Ongoing tobacco settlements and declining class action velocity have moderated perceived risk.

Now that JT has entered the U.S. with a combustible platform (via Vector Group acquisition), the next logical step is acquiring a smokeless brand to achieve operational scale and cross-category leverage.

Zyn: Key Differentiators for Investors

Category | Zyn | Competitors (Velo, Rogue, On!) |

Market Share (US) | 77% | <10% |

FDA Authorization | ✅ | Limited |

Margin Profile | 80–85% | 40–50% |

Branding | Lifestyle + Clean Nicotine | Smokeless Tobacco Legacy |

Regulatory Strategy | PMTA-compliant | Reactive / Limited investments |

• PMI’s acquisition of Swedish Match gave it not only the brand but also the infrastructure and regulatory knowledge to win long-term.

• With FDA Modified Risk Tobacco Product (MRTP) approvals, Zyn is legally marketed as a less harmful alternative to smoking, a unique competitive advantage.

Catalysts

• U.S. Production Ramp: Doubling of Zyn capacity to >500M cans/year

• Investor Day 2025: Updates on long-term RRP revenue contribution and margin guidance

• FDA Engagement: Expansion of MRTP designations across flavor skus

• New Markets: Zyn expansion into Canada, EU, and Asia (potential Japan rollout in 2026)

Risks to Consider

• Regulatory Overhang: U.S. youth access and potential restrictions on flavored pouches (currently under scrutiny)

• Elasticity of Demand: As pricing power is utilized, consumer substitution or reduction could offset volume gains

• Competitor Response: BAT (Velo) and Altria (On!) may aggressively discount or litigate to erode share

Philip Morris International is one of the most compelling secular transformation stories in global equities. With Zyn, PMI has acquired a platform asset in the fastest-growing nicotine category with unmatched economics, regulatory positioning, and consumer adoption. While headline risks around nicotine remain, the company’s risk-adjusted cash flows, dividend yield, and new growth narrative warrant a higher valuation multiple.

Turning Point Brands

Turning Point Brands, Inc. (NYSE: TPB) has emerged as a significant player in the rapidly expanding oral stimulant pouch industry, leveraging its robust brand portfolio and strategic investments to capitalize on shifting consumer preferences toward smokeless alternatives.

The company's modern oral nicotine products, notably the FRE® and ALP brands, have demonstrated impressive growth. In Q4 2024, FRE achieved $11.2 million in sales, marking a 26% sequential increase and contributing to a 25.8% rise in the Stoker’s product segment's net sales. Going forward, Turning Point projects combined modern oral sales to reach between $60 million and $80 million in 2025.

Beyond nicotine, Turning Point is diversifying into functional wellness. In January 2024, the company acquired an 18.7% stake in TeaZa Energy LLC, a brand offering flavorful oral pouches designed as health-conscious alternatives to traditional energy products. This move aligns with the company's strategy to broaden its presence in the oral stimulant market.

Financially, Turning Point reported a 12.8% year-over-year increase in Q4 2024 net sales, totaling $93.7 million. The Zig-Zag segment saw a 1.8% rise, while Stoker experienced a 25.8% increase, underscoring the growing demand for smokeless products.

In summary, Turning Point Brands is strategically positioned to lead in the oral stimulant pouch sector through its innovative product offerings and targeted investments, catering to evolving consumer preferences for healthier, smokeless alternatives.

Strategic Attractiveness

Turning Point Brands (NYSE: TPB) has garnered attention as a potential acquisition target for major tobacco companies aiming to bolster their presence in the U.S. nicotine pouch market. Analysts suggest that companies like Japan Tobacco and Imperial Brands might consider acquiring TPB to enhance their portfolios in this rapidly growing segment. TPB's strong performance in the nicotine pouch category, particularly with its FRE® brand, underscores its appeal. In Q4 2024, FRE achieved $11.2 million in sales, marking a 26% sequential increase. This growth trajectory positions TPB as an attractive candidate for companies seeking to expand their footprint in the modern oral nicotine market.

Imperial Brands has already signaled its interest in the U.S. nicotine pouch sector through its acquisition of a range of nicotine pouches from TJP Labs in 2023. Similarly, Japan Tobacco's limited presence in the U.S. market could be strengthened by acquiring a company like TPB, which boasts established brands and a robust distribution network. TPB's asset-light model and focus on smokeless products align well with the strategic objectives of these global tobacco firms, making it a compelling acquisition prospect.

Portfolio Overview

Turning Point Brands (NYSE: TPB) boasts a diversified portfolio that spans traditional tobacco products, modern oral nicotine alternatives, and cannabis-adjacent accessories. Its iconic Zig-Zag® brand leads the premium rolling paper market in the U.S. and Canada, with a 32.8% market share, and has expanded into cigar wraps and related accessories. The Stoker’s® line holds a significant position in the smokeless tobacco segment, ranking #1 in discount chewing tobacco and #2 in discount moist snuff. In the modern oral category, TPB's FRE® nicotine pouches have experienced rapid growth, complemented by the recent launch of the ALP brand, developed in collaboration with Tucker Carlson. Additionally, the company's strategic investment in TeaZa Energy, a functional wellness pouch brand, underscores its commitment to diversifying its product offerings and meeting evolving consumer preferences.

Investment Highlights

1. Strong Financial Performance

- Revenue Growth: In Q4 2024, TPB reported a 12.8% year-over-year increase in net sales, reaching $93.7 million.

- Adjusted EBITDA: For the full year 2024, adjusted EBITDA rose by 12.0% to $104.5 million, with a 2025 guidance of $108–113 million.

- Earnings Per Share: Q4 2024 adjusted diluted EPS was $0.98, up from $0.82 in the same period the previous year.

2. Leadership in Modern Oral Nicotine Products

- FRE® Brand Growth: The FRE® nicotine pouch brand achieved $11.2 million in Q4 2024 sales, marking a 26% sequential increase.

- 2025 Outlook: TPB projects combined modern oral sales of $60–80 million for 2025, reflecting confidence in this segment's growth.

3. Iconic Brand Portfolio

- Zig-Zag®: A leading brand in rolling papers and wraps, Zig-Zag® contributed $192.3 million in net sales for 2024, a 6.6% increase year-over-year.

- Stoker’s®: Known for moist snuff tobacco (MST) and loose-leaf chew, Stoker’s® net sales grew by 16.4% in 2024, totaling $168.3 million.

4. Strategic Investments and Diversification

- TeaZa Energy Stake: In January 2024, TPB acquired an 18.7% stake in TeaZa Energy, LLC, expanding into the functional wellness space.

- Product Innovation: The company continues to invest in new product development, including the launch of the ALP nicotine pouch brand.

5. Robust Distribution Network

- Retail Presence: TPB's products are available in over 220,000 retail outlets across North America, enhancing market reach and brand visibility.

6. Shareholder-Friendly Capital Allocation

- Dividend Growth: The company increased its quarterly dividend by 7% in February 2025, demonstrating a commitment to returning value to shareholders.

- Share Repurchases: TPB repurchased shares during 2024, reflecting confidence in its valuation and prospects.

Mangoceuticals, Inc. (NASDAQ: MGRX)

Mangoceuticals, Inc. (NASDAQ: MGRX) is strategically positioned at the intersection of healthcare innovation and digital convenience, capitalizing on the rapid expansion of telemedicine. The company specializes in developing a diverse array of health and wellness products targeting both men and women, delivered through a secure and efficient telemedicine platform. Mangoceuticals has identified robust growth opportunities in key healthcare segments, including erectile dysfunction (ED), hair restoration, hormone replacement therapies, and weight management solutions.

Under the flagship brands “MangoRx” and “PeachesRx,” Mangoceuticals provides discreet, physician-supervised healthcare solutions directly to consumers. Interested individuals can seamlessly engage with the company's telemedicine service, undergoing virtual consultations to obtain prescriptions. Upon physician approval, medications are compounded through the company's pharmacy partners and delivered directly to patients' homes, ensuring privacy and convenience.

MangoRx primarily targets men's health needs, including ED, hair growth solutions, hormone therapies, and male-focused weight management. In parallel, PeachesRx addresses the growing market for women's weight management products, reflecting Mangoceuticals' commitment to comprehensive, gender-inclusive health and wellness. The company's digital-first model positions it strongly within the healthcare sector, tapping into increasing consumer preference for telehealth solutions and direct-to-consumer services. For further information, visit MangoRx at www.MangoRx.com and PeachesRx at www.PeachesRx.com.

Mangoceuticals has recently undertaken important steps to position itself for accelerated growth and greater institutional visibility. In Q2 2025, the company completed a 15-to-1 reverse share split, significantly tightening the public float and optimizing the capital structure for future valuation catalysts.

Post-split, Mangoceuticals maintains a strong balance sheet with over $13 million in shareholder equity as of the most recent filings, providing the financial flexibility to support commercialization initiatives, brand launches, and additional strategic investments. The company has simultaneously expanded its intellectual property footprint through a series of targeted technology, patent, and asset acquisitions — most notably the IP portfolio from Smokeless Tech Corp., a transformative move anchoring its entry into the high-growth oral stimulant and wellness pouch market.

Today, Mangoceuticals offers investors a rare opportunity to participate in the re-rating of a newly streamlined Nasdaq-listed house of brands, positioned at a key inflection point:

• House of Brands: A diversified portfolio across prescription-based therapeutics, wellness-focused consumer pouches, and functional products.

• House of Products: A growing suite of SKU launches targeted at high-demand health, energy, mood, and wellness verticals.

• House of Formulations: Proprietary, IP-backed formulations that differentiate Mangoceuticals from generic competitors in both traditional nutraceutical and emerging alternative consumption formats.

Given its tightened float, strategic IP platform, differentiated branding strategy, and financial foundation, Mangoceuticals is poised for enhanced market visibility, improved liquidity dynamics, and potential valuation multiple expansion as it transitions into a leading growth platform in health-focused consumer products.

Transformative Acquisition of Smokeless Technology Corp. IP Assets to Enter Oral Stimulant Pouches

Mangoceuticals, Inc. (NASDAQ: MGRX) has executed a transformative acquisition of Smokeless Technology Corp. ("Smokeless Tech") IP Assets, marking its strategic entry into the rapidly expanding oral stimulant pouch market. ArcStone Securities and Investments Corp. served as the exclusive financial advisor for this cross-border transaction, underscoring ArcStone’s robust capabilities in advising NASDAQ-listed companies and privately held international innovators.

The acquisition significantly enhances Mangoceuticals’ competitive positioning, launching a high-impact new vertical in the consumer packaged goods (CPG) sector targeting athletes, fitness enthusiasts, and Gen Z consumers seeking healthier alternatives to traditional nicotine products. Mangoceuticals now benefits from an experienced executive team led by Tim Corkum, a seasoned industry veteran formerly of Philip Morris International and JUUL Labs Canada, who will spearhead the company’s new Pouch Division. This strategic hire strengthens Mangoceuticals’ market credibility, operational capabilities, and potential for future consolidation within this lucrative segment.

The transaction integrates Smokeless Tech’s proprietary intellectual property, formulations, and established manufacturing relationships with Mangoceuticals’ powerful direct-to-consumer infrastructure and influencer-driven marketing strategy. Furthermore, the deal provides Mangoceuticals with public market currency for future growth initiatives and M&A activity. The combined entity is set to lead innovation in functional wellness and oral stimulant pouch delivery, capturing significant investor interest within the wellness and consumer health markets.

Summary Highlights:

1. Transformational Acquisition of Smokeless Tech IP and Assets

Mangoceuticals has announced the strategic acquisition of all intellectual property, formulations, trademarks, technology, and select manufacturing relationships from Smokeless Technology Corp., a disruptive innovator in the nicotine-alternative and functional pouch category. This acquisition immediately provides Mangoceuticals with a proprietary platform to expand beyond prescription-based products into the high-demand, better-for-you consumer wellness sector. The transaction is structured as an all-share deal, preserving cash while aligning incentives for future growth.

2. Expansion into the Fast-Growing Pouch Market

By acquiring Smokeless Tech’s assets, Mangoceuticals gains immediate entry into the nicotine-free and wellness-based pouch market, a sector experiencing rapid consumer adoption. U.S. unit sales of pouches have grown at a +30–40% CAGR over the past three years, outpacing traditional smokeless products. Philip Morris’s investment in ZYN and Turning Point Brands’ investment in Carlson Tucker’s brand portfolio highlights the enormous opportunity in this emerging format. Mangoceuticals' pouches will focus on energy, mood enhancement, weight management, and general wellness—offering a differentiated product set in a category primed for expansion.

3. Leadership by Seasoned Industry Executive

As part of the transaction, Tim Corkum, a 20-year former executive at Philip Morris International with deep experience in commercializing smokeless and alternative products, will join Mangoceuticals as President of the Pouch Division. His leadership is expected to significantly de-risk execution, drive retail and distribution partnerships, and accelerate time-to-market. Corkum’s proven record in scaling new product categories globally positions Mangoceuticals for immediate credibility and operational excellence in the pouch segment.

4. Platform for Broader Wellness and CPG Growth

The acquired technology, combined with Mangoceuticals’ existing regulatory experience and marketing capabilities, creates a launchpad for broader innovations across the consumer health and wellness space. Future formulations may include adaptogens, energy boosters, functional botanicals, and proprietary therapeutics, extending Mangoceuticals’ reach beyond the pouch category into a diversified CPG portfolio. The acquisition strategically positions Mangoceuticals at the intersection of wellness, innovation, and alternative consumption formats.

5. Significant Re-Rating Opportunity

The Smokeless Tech acquisition represents a pivotal catalyst for MGRX’s valuation. Post-acquisition, Mangoceuticals will be a rare public company platform offering exposure to the high-growth functional pouch and better-for-you CPG sector. As the company executes on product rollout, distribution scaling, and category innovation, we believe MGRX has the potential for meaningful multiple expansion and broader institutional investor interest, like early re-rating patterns observed with companies like Turning Point Brands following their alternative category expansions.

First Pure-Play Oral Stimulant Pouch Platform – A High-Torque Opportunity for Growth Investors

Mangoceuticals Inc. (NASDAQ: MGRX) (“Mangoceuticals”) emerges as the first true pure-play public company focused on the high-growth oral stimulant and wellness pouch market, offering a unique value proposition at the intersection of nutraceutical innovation, brand diversification, and differentiated consumer engagement.

Through the acquisition of Smokeless Tech’s IP and assets, Mangoceuticals gains control of a diversified "house of brands" strategy designed around disruptive formulations — including proprietary energy, mood, focus, and wellness pouches — that leverage patented and patent-pending technologies. Unlike many competitors offering generic or commoditized energy products, Mangoceuticals’ formulations are rooted in advanced nutraceutical science, offering functional benefits beyond caffeine, including adaptogens, cognitive enhancers, and novel stimulant blends.

This differentiated platform positions Mangoceuticals to disrupt an oral pouch category that has already demonstrated explosive growth but remains heavily dominated by nicotine-based products (e.g., ZYN by Philip Morris and other tobacco-linked brands).

Key Strategic Advantages:

- First-Mover Advantage: Mangoceuticals is the first Nasdaq-listed small-cap company offering pure-play exposure to the stimulant and wellness pouch sector without nicotine dependencies.

- Brand Diversification: The company's "house of brands" approach allows it to target multiple consumer demographics — from athletic performance to wellness and mental focus — creating broader addressable markets than nicotine-only products.

- Proprietary Formulations: With IP-protected ingredients and unique delivery systems, Mangoceuticals moves beyond commodity energy products, positioning itself as a category creator in functional wellness pouches.

- Institutional Access to a Scarce Asset: Today, institutional investors have few opportunities to participate in the pouch sector outside of large-cap companies like Philip Morris (NYSE: PM) or Turning Point Brands (NYSE: TPB), both of which offer diluted exposure within broader tobacco or nicotine portfolios. Mangoceuticals offer a high-torque, concentrated exposure to the stimulant and wellness pouch opportunity, designed for investors seeking alpha from emerging trends rather than incremental legacy growth.

- Attractive Small-Cap Dynamics: As an emerging Nasdaq-listed company, Mangoceuticals is positioned to benefit from multiple expansion as it scales distribution, builds brand equity, and captures early share in a market that is still in its infancy for non-nicotine-based offerings.

Functional Caffeine Pouches

LF*GO!™ is redefining the energy supplement landscape with its innovative, nicotine-free caffeine pouches. Each pouch delivers 200mg of natural caffeine sourced from green coffee beans, complemented by six essential vitamins and minerals. This formulation offers a clean, sugar-free, and calorie-free energy boost, catering to health-conscious consumers seeking alternatives to traditional energy drinks and coffee.

Product Highlights

- Caffeine Content: 200mg per pouch, equivalent to approximately two cups of coffee.

- Nutritional Profile: Enriched with Vitamin D3, Niacin, Vitamin B6, Folate, Vitamin B12, and Chromium.

- Flavor Varieties: Sour Cherry, Mint, Strawberry Kiwi, and Orange Tangerine.

- Packaging: Each can contain 15 pouches, priced at $29.99 for a 4-flavor bundle.

Market Positioning

LF*GO!™ positions itself as a premium, on-the-go energy solution for active individuals, professionals, and fitness enthusiasts. Its discreet and portable design appeals to consumers seeking convenient energy supplementation without the drawbacks of liquid energy drinks.

Consumer Feedback

Customer reviews highlight the product’s effectiveness in providing sustained energy and its appealing flavor profiles. However, some users have reported gum irritation and a burning sensation, particularly with certain flavors. These experiences suggest a need for potential formulation adjustments to enhance user comfort.

Strategic Considerations

- Product Development: Addressing consumer feedback on oral discomfort could improve user experience and broaden market appeal.

- Market Expansion: Exploring partnerships with fitness centers, corporate wellness programs, and retail outlets could enhance brand visibility and accessibility.

- Regulatory Compliance: Ensuring clear labeling and usage guidelines will be crucial in maintaining consumer trust and meeting health regulations.

Conclusion

LF*GO!™’s innovative approach to energy supplementation positions it well within the growing functional product market. By addressing user feedback and strategically expanding its market presence, LF*GO!™ has the potential to become a leading brand in the caffeine pouch segment.

Haypp Group AB, Ticker: HAYPP.ST

Company Overview

Founded in 2009 and headquartered in Stockholm, Sweden, Haypp Group AB is a leading online retailer specializing in tobacco-free nicotine pouches and snus products. With operations spanning Sweden, Norway, the United States, the United Kingdom, Germany, Austria, and Switzerland, the company manages a portfolio of eleven e-commerce brands, including Snusbolaget.se, Northerner.com, and Nicokick.com. Haypp Group’s mission is to drive the global transition from smoking to healthier, smoke-free alternatives through a consumer-centric, digital-first approach.

Financial Performance

Haypp Group has demonstrated robust financial growth over recent years:

- Net Sales: Increased from SEK 2.6 billion in 2022 to SEK 3.68 billion in 2024.

- Adjusted EBIT: Improved from SEK 58.5 million in 2022 to SEK 134.5 million in 2024.

- Profit: Achieved a net profit of SEK 45 million in 2024, up from SEK 20.1 million in 2022.

The company has set ambitious financial targets, aiming to reach net sales of SEK 5 billion by 2025 through organic growth, with an adjusted EBIT margin in the high single digits.

Business Model & Strategy

Haypp Group operates a scalable, direct-to-consumer e-commerce model focused on:

- Consumer Engagement: Leveraging data-driven insights to attract and retain customers.

- Product Diversification: Expanding offerings to include nicotine pouches, snus, and vaping products.

- Market Expansion: Entering new geographical markets and adjacent product categories.

The company’s sustainable business model emphasizes ESG considerations, aiming to provide healthier alternatives to traditional tobacco products.

Recent Developments

- Q4 2024 Performance: Reported a 23% increase in net sales on a like-for-like basis, with nicotine pouch volumes rising by 37%.

- Market Presence: Served over 1.14 million active customers across seven countries in 2024.

- Product Innovation: Successfully piloted nicotine vaping products in the UK, signaling entry into adjacent markets.

Outlook

Haypp Group is well-positioned to capitalize on the growing demand for smoke-free nicotine alternatives. With a strong digital infrastructure, diverse product portfolio, and commitment to sustainability, the company aims to continue its trajectory of profitable growth and market expansion.

Disclaimer and Forward Looking Statements

ArcStone Securities and Investments Corp. (“ArcStone”) acts as a Financial Advisor to Mangoceuticals Inc. This report is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. No investment decision should be based on the information contained herein. Any investment in securities involves significant risks, and potential investors should conduct their own independent due diligence and consult with their financial, legal, and tax advisors before making any investment decision. This document is not intended to provide legal, financial, or investment advice. This document has been prepared by ArcStone Securities and Investments Corp. for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities. The information contained herein is subject to change without notice, and ArcStone assumes no obligation to update or revise any information. This document includes certain statements that constitute “forward-looking statements” within the meaning of applicable Canadian and United States securities laws. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “believe,” “anticipate,” “estimate,” “project,” “intend,” “expect,” “may,” “will,” “plan,” “should,” “would,” “contemplate,” “possible,” “attempts,” “seeks,” “goals,” “targets,” and similar expressions. These statements are based on current expectations, estimates, projections, and assumptions, and involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements in this document may include, but are not limited to, statements regarding the subject of the company's outlook, anticipated events or results, exploration and development plans, financial position, business strategy, budgets, litigation, projected costs, financial results, taxes, plans, and objectives. These statements are based on certain assumptions and analyses made by management considering their experience and perception of historical trends, current conditions, and expected future developments, as well as other factors they believe are appropriate in the circumstances. However, actual results and developments are subject to a number of risks and uncertainties, including but not limited to, risks inherent to mineral exploration and development activities, changes in commodity prices, changes in interest and currency exchange rates, inaccurate geological and metallurgical assumptions, unanticipated operational difficulties, government action or delays in the receipt of government approvals, adverse weather conditions, unanticipated events related to health, safety, and environmental matters, labor disputes, political risk, social unrest, failure of counterparties to perform their contractual obligations, changes or further deterioration in general economic conditions, and other risks discussed under the heading "Risk Factors" in the subject company's most recently filed MD&A. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made. Except as required by applicable law, ArcStone assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions, or changes in other factors affecting the forward-looking statements. This document is not, and under no circumstances is to be construed as, a prospectus, a public offering, or an offering memorandum as defined under applicable securities legislation anywhere in Canada, the United States, or in any other jurisdiction. Neither this document nor anything in it shall form the basis of any contract or commitment. This document is not intended to be relied upon as advice to investors or potential investors and does not consider the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. ArcStone Securities and Investments Corp. has a FINRA registered Broker Dealer, ArcStone Securities LLC. In Canada, all registrable activities are conducted through Gillford Capital Inc., which is registered as an Exempt Market Dealer (EMD) in Ontario, Alberta, and British Columbia.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.