The Next Great Canadian Gold Story: Why You Should Be Watching White Gold

White Gold Snapshot

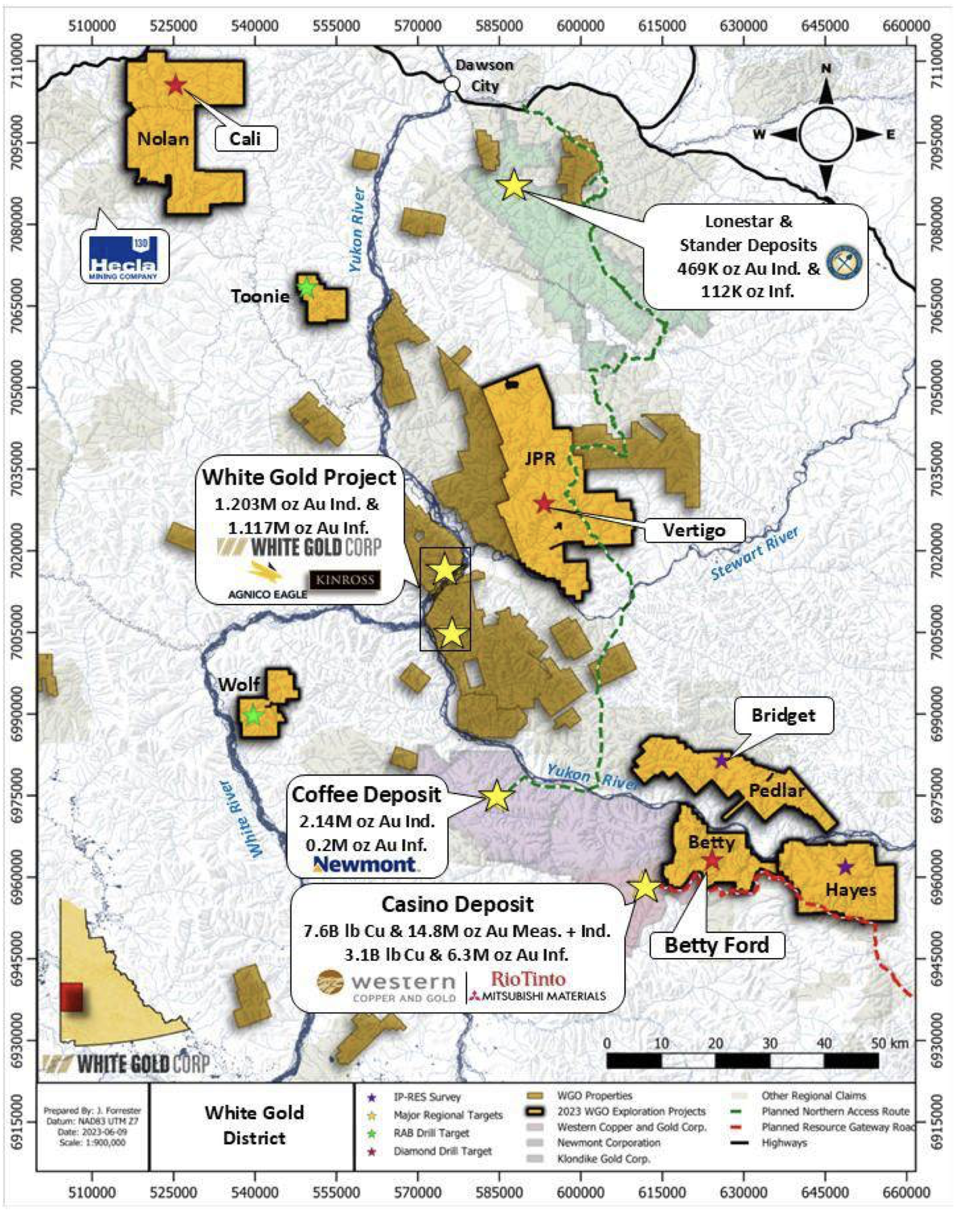

• White Gold Corp. (TSX-V: WGO; OTCQX: WHGOF) is a Canadian mineral exploration company focused on the prolific White Gold District in Yukon, Canada. The company holds a dominant land position in the region, with a portfolio comprising 15,876 quartz claims across 26 properties, covering approximately 315,600 hectares—representing ~40% of the district.

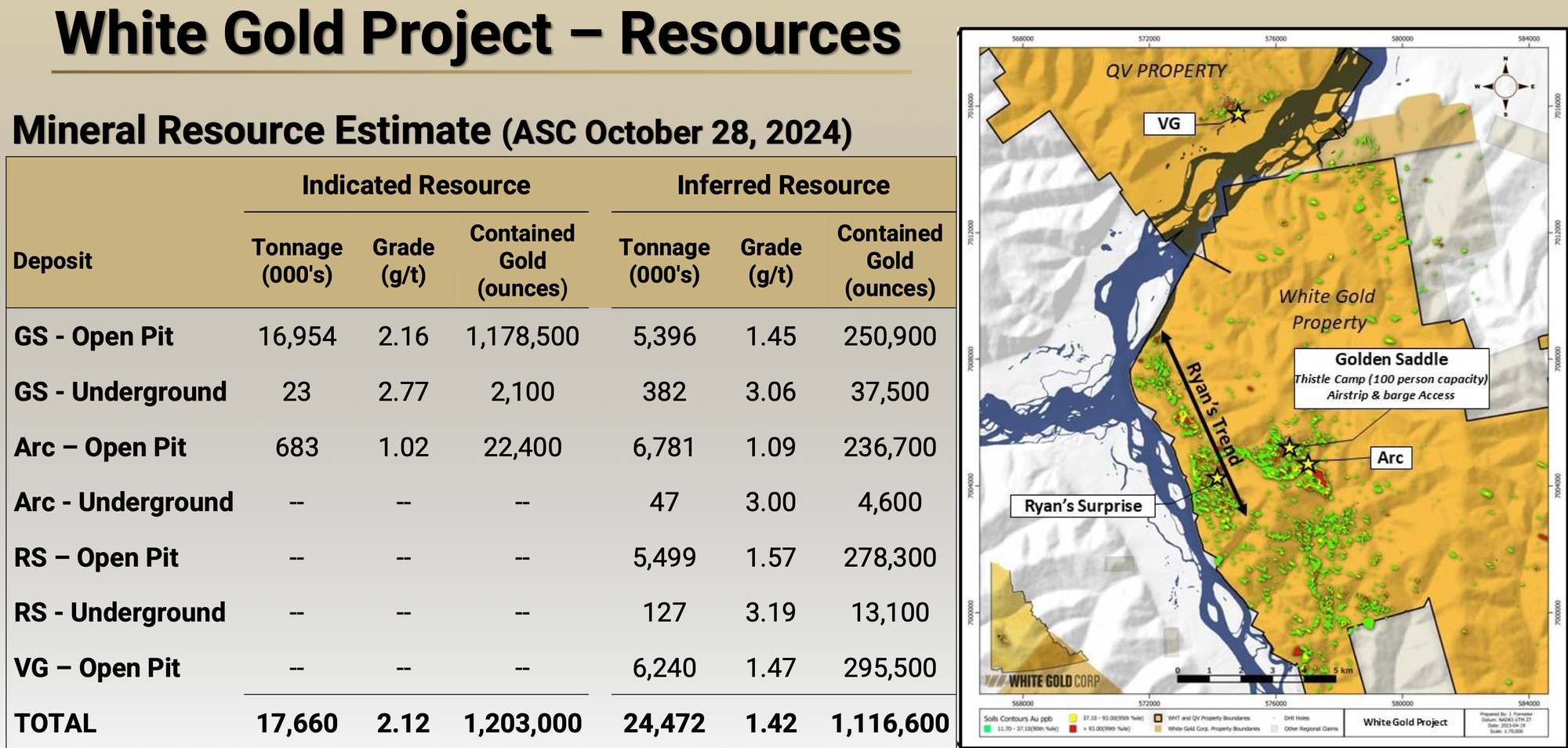

• The company's flagship White Gold Project includes four near-surface gold deposits: Golden Saddle, Arc, Ryan’s Surprise, and VG. As of the latest mineral resource estimates, the project hosts approximately 1.2 million ounces of gold in the Indicated category and 1.1 million ounces in the Inferred category . The Golden Saddle deposit, in particular, features a high-grade core with significant potential for expansion, as mineralization remains open in multiple directions.

• Strategically located near major projects like Newmont's Coffee and Western Copper and Gold's Casino, White Gold Corp.'s properties benefit from proximity to established infrastructure and mining activities . The company continues to explore and develop its assets, aiming to expand its resource base and unlock the district's full potential.

• Headquartered in Toronto and founded in 2017, White Gold Corp. leverages a strong technical team and strategic partnerships to advance its exploration initiatives in one of Canada's most promising gold districts.

Share Price Performance

• White gold is up 57+% YTD 2025 period

Macro Themes Favourable for Junior Gold

• The U.S. dollar has fallen sharply since the start of the year, which has boosted commodity prices - especially metals like gold and silver - due to their inverse relationship.

• This decline stems from several factors, including a plunging stock market that triggered foreign capital outflows, rising recession risks and expectations of future interest rate cuts, and growing uncertainty over America’s new tariff policies.

- The coming dollar bear market will spark a powerful commodities supercycle - similar to the one that began in the early 2000s, when everything from copper to oil to wheat saw massive gains.

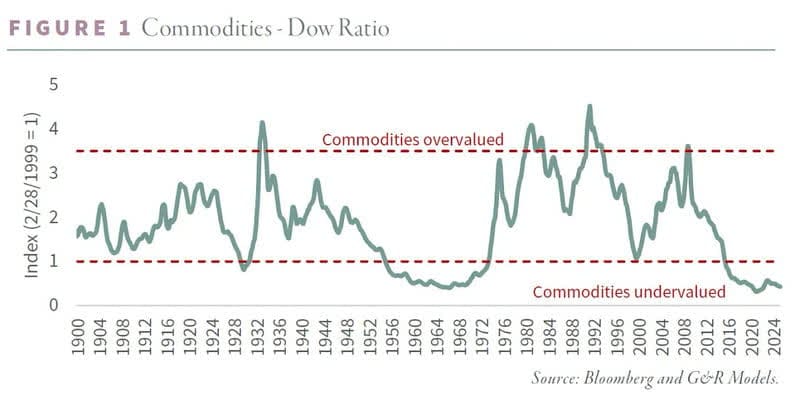

- Further supporting this outlook is the extremely low valuation of commodities relative to U.S. stocks, as shown in the chart below.

- When this ratio reaches such extremes - as it has now - it often snaps back sharply, triggering major moves across the entire commodities complex.

- In times of market volatility, such as the current U.S.-China trade war, gold serves as a reliable hedge, making SPDR Gold Shares ETF a strong portfolio addition.

- Historical data shows gold outperformed SPY during the 2018-2019 trade war, suggesting a repeat is possible with renewed trade tensions.

- Options market analysis indicates bullish momentum for GLD, with significant gamma exposure targeting $310-$330, supported by institutional buying in dark pools.

- Risks include potential easing of trade tensions and unexpected inflation spikes, but the potential rewards for GLD outweigh these risks in the short to medium term.

Investment Highlights

- Dominant Land Position in a Prolific District: White Gold Corp. controls over 40% of the emerging White Gold District in Yukon, Canada, encompassing 26 properties over approximately 315,600 hectares. This extensive land package provides a significant strategic advantage in a region known for its mineral potential.

- Significant Defined Gold Resources: The company's flagship White Gold Project boasts a substantial mineral resource estimate, including 1,203,000 ounces of gold in the Indicated category at an average grade of 2.12 g/t Au and 1,116,600 ounces in the Inferred category at an average grade of 1.42 g/t Au. These resources are primarily near-surface and amenable to openpit mining, enhancing the project's economic viability.

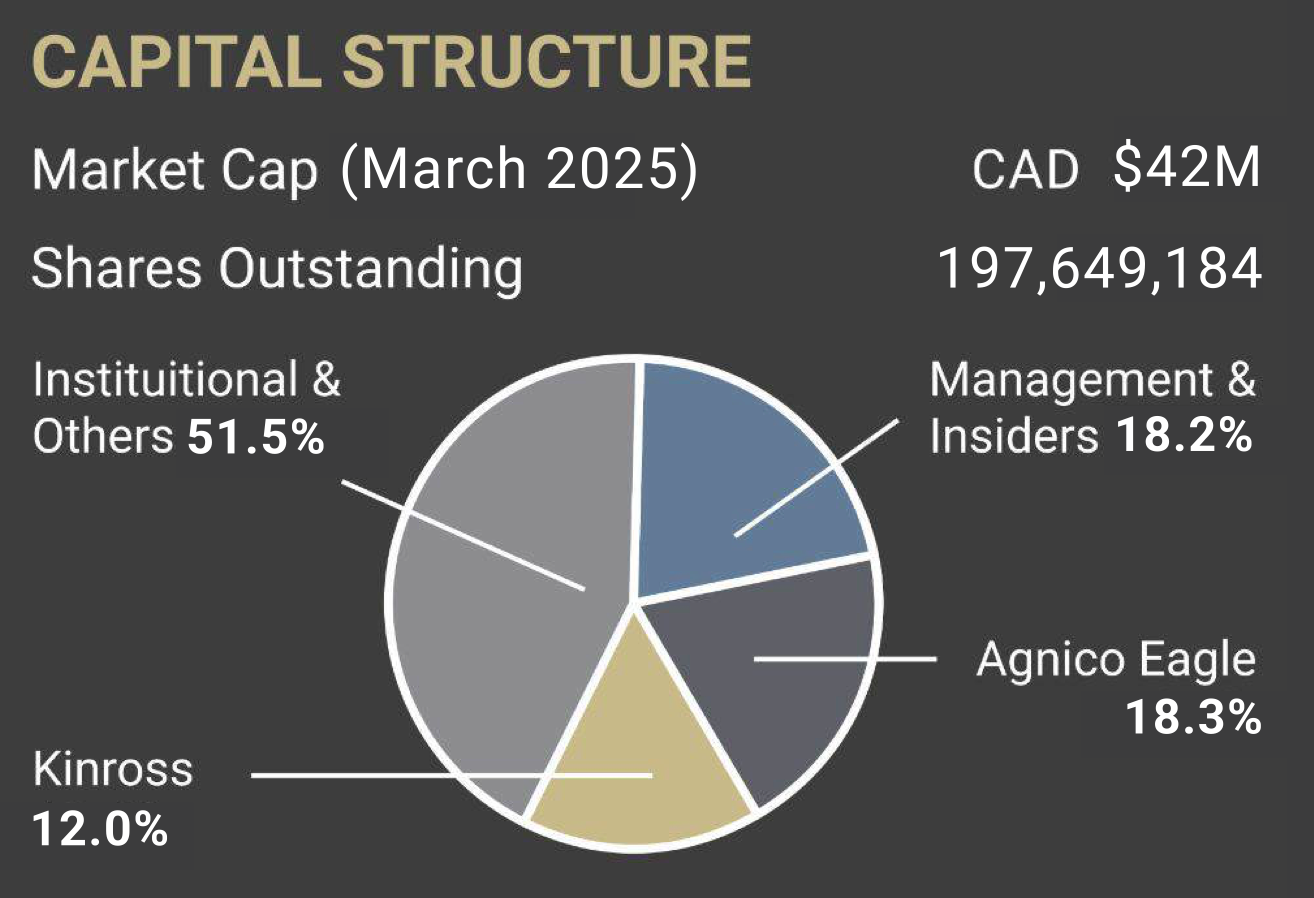

- Strategic Partnerships with Major Mining Companies: White Gold Corp. benefits from strong strategic partnerships, with Agnico Eagle Mines Limited and Kinross Gold Corporation holding 19.9% and 13.4% stakes, respectively. These alliances provide valuable technical expertise and financial support, bolstering the company's exploration and development efforts.

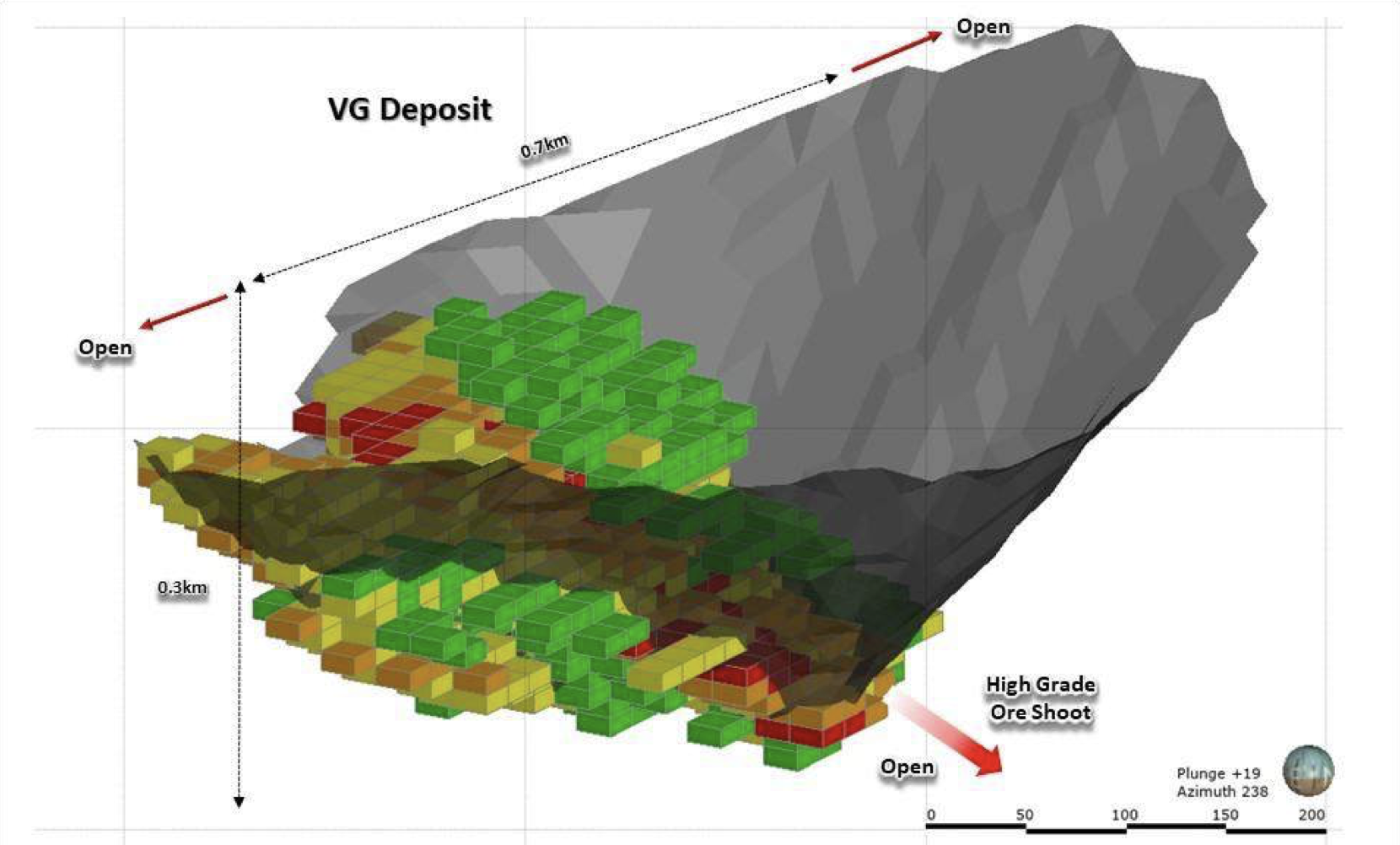

- Expansion Potential: All four deposits—Golden Saddle, Arc, Ryan’s Surprise, and VG—remain open along strike and at depth, indicating strong potential for resource expansion. Additionally, there is an estimated 10–12 million tonnes of material grading between 1–2 g/t Au classified as a Target for Further Exploration (TFFE), which could further augment the resource base.

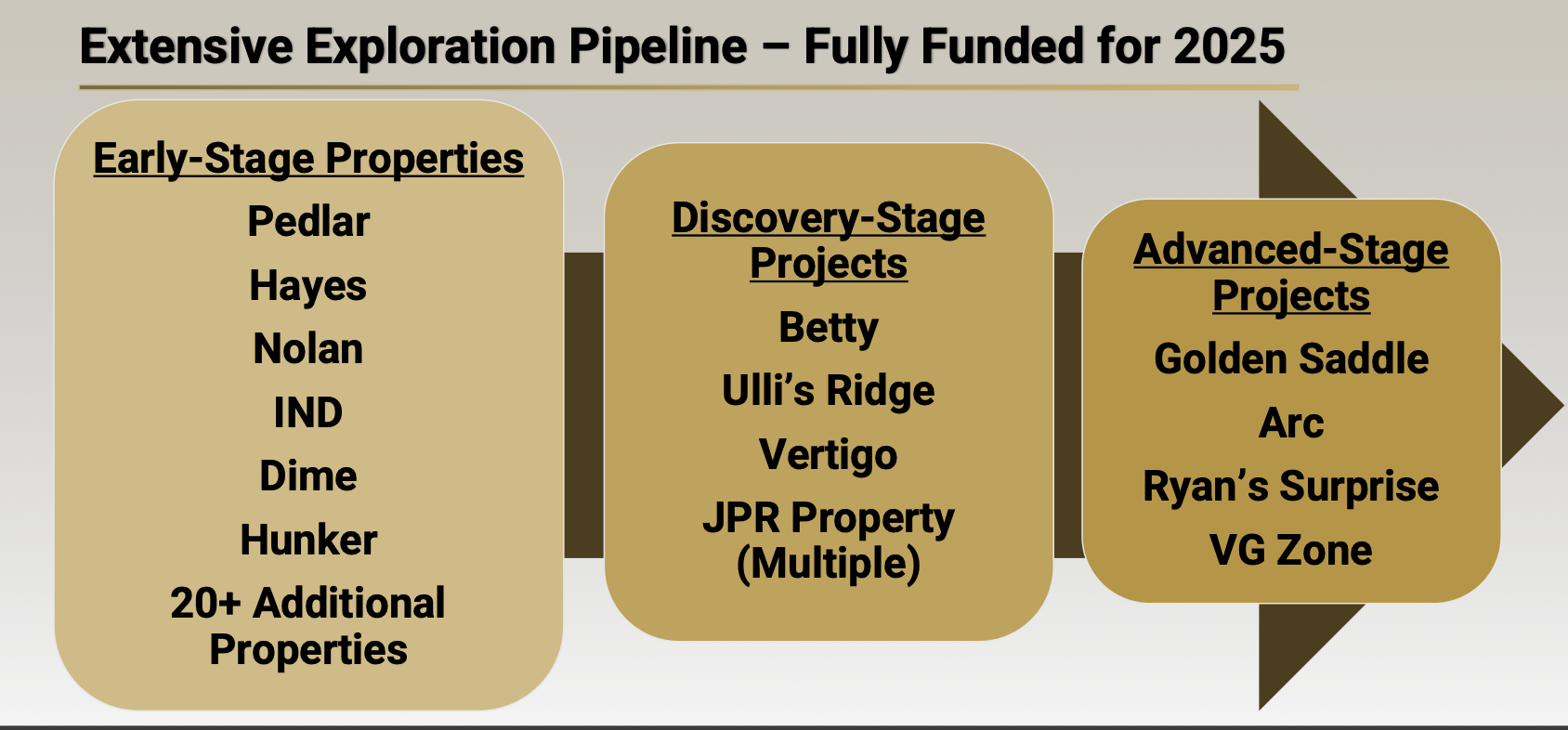

- Robust Exploration Pipeline: The company's innovative, data-driven exploration strategy has led to multiple high-grade discoveries, including the Betty Ford target, which has yielded impressive drill results such as 8.94 g/t Au over 18.29 meters. The extensive exploration database, comprising over 280,000 soil samples, underpins a robust pipeline of prospective targets.

- Exposure to Critical Minerals: Beyond gold, White Gold Corp.'s land package is prospective for several critical minerals, including copper, molybdenum, tungsten, antimony, and bismuth. The company is evaluating strategies to unlock the value of these assets, which could provide additional growth avenues and align with global trends toward critical mineral development.

- Favorable Jurisdiction with Infrastructure Support: Operating in Yukon, a top-tier mining jurisdiction known for its supportive regulatory environment and infrastructure investments, White Gold Corp. is well-positioned to advance its projects. The region has seen over $360 million committed to infrastructure improvements, including roads and power, facilitating project development.

- Experienced Management and Technical Team: Led by renowned prospector Shawn Ryan, who has been instrumental in multiple significant discoveries in the district, the company's management and technical teams bring a wealth of experience and a proven track record in mineral exploration and development. David D’Onofrio, CEO is a proven mining executive and financier and works at the premier financial firm PowerOne which has one of the top track records in Canada.

Shawn Ryan

CO-FOUNDER & CHIEF TECHNICAL ADVISOR, DIRECTOR

Shawn has over 20 years of experience prospecting gold across the Yukon. A global leader in his field, his prospecting and specialization on advanced soil work led to the discovery of the millions of gold ounces including the Golden Saddle & Arc, Coffee, and QV gold resources. This success has also been recognized with Shawn winning the 2011 PDAC Prospector of the Year Award, 2010 Spud Huestis Award and the 1998 Yukon Chamber of Mines Prospector of the Year Award. Shawn continues to be an active participant with his technical teams, constantly improving efficiencies with his methodological exploration techniques.

David D'Onofrio

CHIEF EXECUTIVE OFFICER, DIRECTOR

David has over a decade of experience in corporate finance and capital markets with a focus on the natural resource sector. As an executive with the PowerOne Group he has developed a depth of knowledge in representing, advising, and assisting emerging companies in accessing capital, advising on mergers and acquisitions and managing their businesses. David is a Chartered Professional Accountant and has also served in a variety of executive roles and director positions to a wide array of private and public enterprises.

Terry Brace

VP, EXPLORATION

Terry Brace joined White Gold Corp. as Vice President of Exploration in February 2020. He holds a Master of Science degree in Earth Sciences (Geology) from Memorial University of Newfoundland and is a Professional Geoscientist registered in the provinces of Newfoundland and Labrador and Ontario. Terry has over 30 years of diversified experience in the mineral exploration and mining industry, covering exploration, environmental management, project permitting, human resources management and community relations. He has held senior positions with major, mid-tier and junior companies including Teck Resources, Noranda, Pan American Silver, Cornerstone Resources and Thundermin Resources. During that time, Terry worked on and managed projects in several regions of Canada and in Latin America, with a focus on precious and base metals in a wide range of deposit types.

District Scaled Land Package

- White Gold is the largest land holder in the White Gold District. This mining jurisdiction is a tier 1 area. 20M+ oz placer gold and 25M+ oz modern day gold discoveries. There is also a $260M resource gateway road infrastructure project underway and the area is ranked top 10 globally by the Fraser Institute

- The White Gold project consists of 1,203,000 oz AU lnd. And 1,116,600 oz AU Inf. Substantially near surface and open pittable, all open along strike and at depth for expansion.

- White Gold Corp.'s latest Mineral Resource Estimate highlights a robust and growing resource base across multiple deposits within the White Gold District of Yukon, Canada. The project hosts a total Indicated Resource of 1,203,000 ounces of gold at an average grade of 2.12 g/t Au, and an Inferred Resource of 1,116,600 ounces of gold at an average grade of 1.42 g/t Au. The resources are primarily near-surface and amenable to open-pit mining, with over 97.5% of the resource tonnage within open-pit limits, enhancing development optionality and future scalability.

- The flagship Golden Saddle deposit represents the majority of the Indicated resource, with 1,178,500 ounces at 2.16 g/t Au in open-pit configuration and an additional underground component. The Arc deposit adds another 22,400 ounces Indicated, and contributes significantly to Inferred resources alongside the Ryan’s Surprise (RS) and VG deposits. Ryan’s Surprise, notably, contains 278,300 ounces Inferred at a strong average grade of 1.57 g/t Au, while VG adds 295,500 ounces Inferred at 1.47 g/t Au, showcasing the project’s multi-deposit scalability.

- All deposits remain open along strike and at depth, and several mineralized zones—including the Ryan’s Trend—remain under-explored. Furthermore, a Target for Further Exploration (TFFE) encompassing an additional 10–12 million tonnes grading 1–2 g/t Au has been identified, which could materially expand future resource updates. With four defined deposits (Golden Saddle, Arc, Ryan’s Surprise, VG) located within a 12 km radius and accessible via road, airstrip, and barge, the White Gold Project is well-positioned to advance toward future development while continuing to grow its resource base.

- The company also new discovery potential:

Betty Ford:

- 3.46 g/t Au over 50M

- 8.94 g/t Au over 18.29M

- 3.38 g/t Au over 53M

Vertigo:

- 9.46 g/t Au over 22.86M

Mineral Resource Estimate

Capital Structure

- The company has 197.6 mm shares outstanding with management, insiders and two strategic partners owning ~48.5% of the company, highly aligning “smart money” with public shareholders.

- The significant equity stakes held by Agnico Eagle Mines Limited (18.3%) and Kinross Gold Corporation (12%) in White Gold Corp. are highly strategic and underscore the project's potential within the Yukon’s White Gold District. Both Agnico Eagle and Kinross have a history of making strategic investments in junior mining companies to gain exposure to promising exploration projects. For instance, Agnico Eagle's investments in companies like Collective Mining Ltd. and ATEX Resources Inc. reflect its strategy of acquiring to hold positions in projects with high geological potential . Similarly, Kinross has made strategic investments in companies such as Relevant Gold and Puma Exploration to expand its exploration portfolio . Their combined ownership not only provides White Gold Corp. with financial backing but also brings technical expertise and potential collaborative opportunities, enhancing the company's ability to advance its exploration and development activities effectively.

Disclaimer and Forward Looking Statements

This document has been prepared by ArcStone Securities and Investments Corp. (“ArcStone”) for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities. The information contained herein is subject to change without notice, and ArcStone assumes no obligation to update or revise any information. This document includes certain statements that constitute “forward-looking statements” within the meaning of applicable Canadian and United States securities laws. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “believe,” “anticipate,” “estimate,” “project,” “intend,” “expect,” “may,” “will,” “plan,” “should,” “would,” “contemplate,” “possible,” “attempts,” “seeks,” “goals,” “targets,” and similar expressions. These statements are based on current expectations, estimates, projections, and assumptions, and involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements in this document may include, but are not limited to, statements regarding the subject company's future outlook, anticipated events or results, exploration and development plans, financial position, business strategy, budgets, litigation, projected costs, financial results, taxes, plans, and objectives. These statements are based on certain assumptions and analyses made by management in light of their experience and perception of historical trends, current conditions, and expected future developments, as well as other factors they believe are appropriate in the circumstances. However, actual results and developments are subject to a number of risks and uncertainties, including but not limited to, risks inherent to mineral exploration and development activities, changes in commodity prices, changes in interest and currency exchange rates, inaccurate geological and metallurgical assumptions, unanticipated operational difficulties, government action or delays in the receipt of government approvals, adverse weather conditions, unanticipated events related to health, safety, and environmental matters, labor disputes, political risk, social unrest, failure of counterparties to perform their contractual obligations, changes or further deterioration in general economic conditions, and other risks discussed under the heading "Risk Factors" in the subject company's most recently filed MD&A. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made. Except as required by applicable law, ArcStone assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions, or changes in other factors affecting the forward-looking statements. This document is not, and under no circumstances is to be construed as, a prospectus, a public offering, or an offering memorandum as defined under applicable securities legislation anywhere in Canada, the United States, or in any other jurisdiction. Neither this document nor anything in it shall form the basis of any contract or commitment. This document is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. ArcStone Securities and Investments Corp. is not a registered broker-dealer and does not provide investment advice or recommendations. All registrable activities and services, including capital raises in the USA, are provided through ArcStone Securities LLC and Kingswood US, both of which are FINRA-registered broker-dealers. In Canada, all registrable activities are conducted through Gillford Capital Inc., which is registered as an Exempt Market Dealer (EMD) in Ontario, Alberta, and British Columbia.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.