The Rise of Micro-Cap Robotic Stocks: Emerging Opportunities for Investors

In the dynamic world of robotics and automation, small-cap and micro-cap companies are often overlooked in favor of larger, more established firms. Yet these emerging companies are where innovation flourishes, offering investors substantial opportunities to benefit from disruptive technologies. Robotics, automation, and artificial intelligence are no longer confined to factory floors but have expanded across healthcare, logistics, agriculture, and beyond. For forward-looking investors, micro-cap robotic stocks provide a unique chance to capitalize on high-growth potential within this transformative industry.

The Growth of Robotics and Automation

Over the past decade, the robotics and automation industry has undergone exponential growth. This progress is fueled by three key factors:

- Advancing Technologies: From machine learning to computer vision, enabling technologies have become more sophisticated and cost-effective. Companies that pioneer these advancements, such as AI-driven sensing systems and robotic actuators, are well-positioned to disrupt traditional sectors.

- Diverse Applications: Robotics has moved beyond manufacturing into industries like healthcare, logistics, and agriculture. Surgical robots now perform over one million procedures annually, while drones monitor crop health and autonomous vehicles streamline deliveries.

- Macro Challenges: Aging populations, labor shortages, and the need for greater efficiency have accelerated robotics adoption. These trends are further amplified by pandemic-driven changes in consumer behavior, such as the rapid rise of e-commerce.

The result is a thriving ecosystem of companies pushing the boundaries of innovation. The ROBO Global Robotics and Automation Index, launched in 2013, tracks many of these developments, providing exposure to the broader robotics and automation landscape. Since its inception, the index has achieved an annualized return of 15.36%, showcasing the strong growth of Robotics and Automation companies over the past decade.

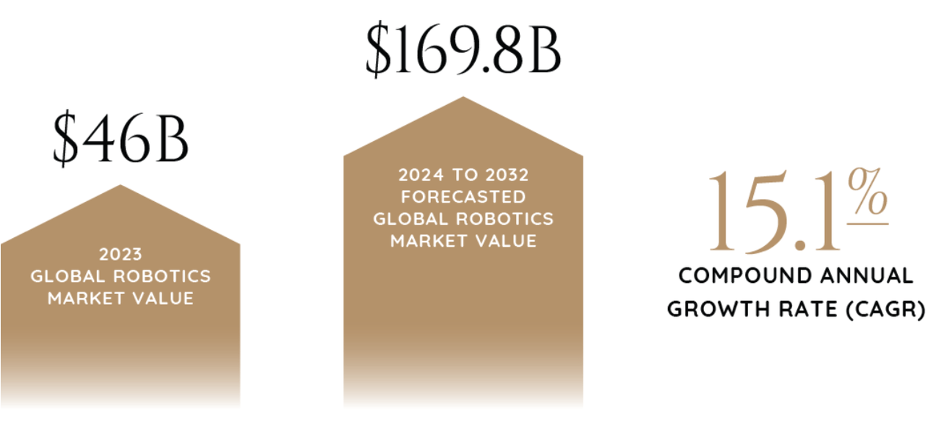

For investors, the robotics revolution represents a unique and compelling opportunity. The sector offers immense growth potential, with global robotics market value to reach approx. $170 billion in revenue by 2032, up from $46 billion in 2023—a staggering compound annual growth rate of 15%. Other markets, such as industrial automation and healthcare AI, are expected to reach $384 billion and $51 billion, respectively, by 2025.

Source: Global X

Why Micro-Cap Robotics Stocks Deserve Attention

Micro-cap stocks, with market capitalizations below $300 million, are often dismissed due to perceived risks or lower visibility. However, in sectors like robotics and AI, these companies are often at the forefront of innovation. Many micro-cap firms specialize in niche technologies or target emerging markets, positioning themselves as key contributors to the industry's growth.

One example is iRobot Corporation, known for its consumer robotics, including the popular Roomba robotic vacuum. Despite its recent challenges, iRobot remains a key player in household robotics, continuously innovating to enhance home automation technologies.

Another standout is Arbe Robotics Ltd., which specializes in high-resolution 4D imaging radar systems for autonomous vehicles. Its technology provides superior object detection and mapping capabilities, making it essential for safe and reliable self-driving systems.

Lastly, Richtech Robotics Inc. focuses on providing robotic solutions for the hospitality and retail industries. The company's offerings, such as robotic waitstaff and automated food delivery systems, are gaining traction as businesses seek innovative ways to enhance customer service and efficiency.

Key advantages of micro-cap robotics stocks include:

- Higher Growth Potential: With smaller revenue bases, micro-cap companies can grow rapidly as they scale their operations or secure high-profile contracts.

- Early Entry to Disruption: Investing in micro-cap stocks allows investors to gain exposure to cutting-edge technologies before they gain widespread adoption.

- Acquisition Opportunities: Many micro-cap robotics firms are prime targets for acquisition by larger companies, offering potential upside for investors.

Investing in micro-cap stocks carries inherent risks, including higher volatility and lower liquidity compared to larger companies. However, for investors with a higher risk tolerance and a keen interest in the robotics and AI sectors, these micro-cap companies can provide opportunities to participate in early-stage innovations with substantial growth potential.

Industry Trends Driving Growth

Post-Pandemic Acceleration

The COVID-19 pandemic highlighted the need for automation across industries. E-commerce adoption, for instance, accelerated exponentially, driving demand for logistics and warehouse automation. The "touchless economy" is now a permanent fixture, and robotics will play a critical role in meeting these new demands.

Sensing and Actuation

The sensing subsector, which includes technologies like machine vision and environmental monitoring, has emerged as a critical component of automation. Companies like Omron and Keyence have demonstrated strong growth in this area. Similarly, advancements in robotic actuation are expanding the capabilities of autonomous systems across various applications.

AI Integration

AI technologies are increasingly being integrated into robotics, enhancing capabilities such as decision-making, machine learning, and predictive analytics. The convergence of AI and robotics is expected to drive the next wave of innovation, particularly in areas like autonomous vehicles and healthcare robotics.

Tesla: The Ultimate Real-World AI Robotics Company

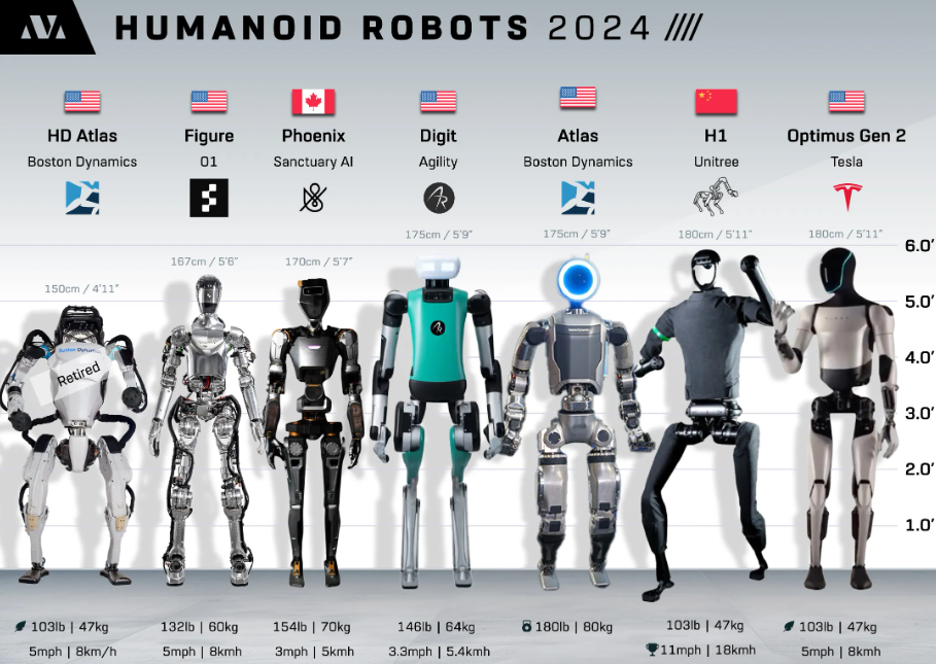

Tesla is not only pioneering autonomous vehicles but also positioning itself as a leader in robotics with ground-breaking advancements. The Tesla Bot, or Optimus, is a humanoid robot designed to perform tasks that are repetitive, dangerous, or physically demanding. Leveraging the same neural network architecture and AI training systems as its Full Self-Driving (FSD) technology, Optimus is being developed to interact seamlessly with the physical world. Tesla's significant investment in robotics aligns with its vision to revolutionize industries such as manufacturing, logistics, and domestic work, further expanding its real-world AI applications.

What sets Tesla apart in the robotics space is its approach to scalability and cost-efficiency. By integrating its robotics development with existing AI and hardware platforms, Tesla ensures rapid progress while keeping production costs low. The Tesla Bot's design focuses on adaptability, featuring a lightweight frame and dexterous hands capable of performing complex tasks. With the potential for widespread adoption in homes, factories, and commercial environments, Tesla's robotics initiative has the capacity to redefine labor economics and unlock unprecedented efficiencies.

Source: Lifearchitect.ai

The Future of Robotics

The robotics revolution is still in its early stages, with exponential technological changes, an abundance of disruption, and unprecedented levels of innovation shaping the industry's trajectory. The integration of AI into robotics is expected to drive even greater advancements, enabling robots to perform complex tasks with higher levels of intelligence and adaptability.

Micro-cap robotics stocks represent an exciting frontier for investors looking to capitalize on the transformative power of robotics, automation, and AI. While the risks of investing in micro-cap stocks are higher, the potential rewards are equally compelling. By focusing on diversification, conducting thorough research, and maintaining a long-term perspective, investors can position themselves to benefit from the exponential growth of the robotics and automation sector.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.