The Rise of Quantum Computing in Finance

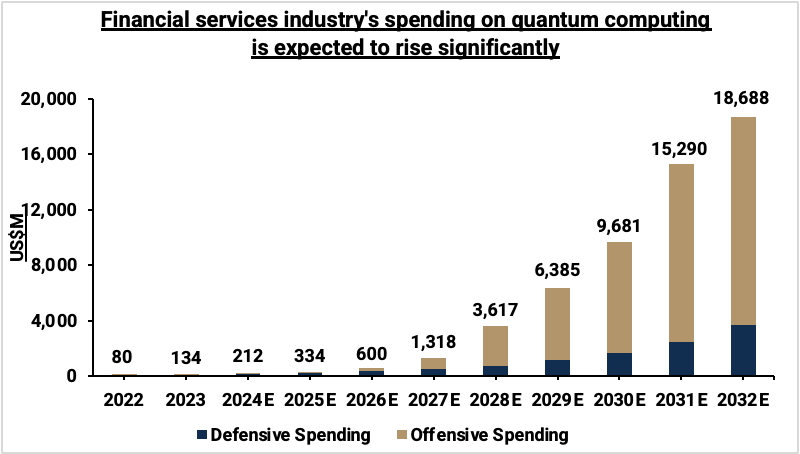

Quantum computing, with its unprecedented computational power, is reshaping how the financial sector addresses complex challenges in portfolio optimization, risk management, and derivatives pricing. Quantum technology has evolved significantly over the past decade, and financial institutions are increasingly exploring its potential to optimize large-scale data-driven tasks that traditional computing cannot efficiently handle. Spending on quantum capabilities by financial services institutions is expected to surge, with projections of a 233-fold increase, rising from $80 million in 2022 to $19 billion by 2032, reflecting a 72% CAGR over a decade, according to Deloitte.

Understanding Quantum Computing in Finance

Unlike classical computers that process data using binary bits (0 or 1), quantum computers utilize quantum bits (qubits). Leveraging principles such as superposition and entanglement, qubits allow for exponentially greater processing power. These capabilities are particularly advantageous in finance, where large datasets and intricate models are often computationally prohibitive on classical systems.

For example, J.P. Morgan’s Quantum Finance Lab has worked on mean-variance portfolio optimization using IBM’s quantum computing solutions. Through quantum algorithms like the Quantum Approximate Optimization Algorithm (QAOA) and the Variational Quantum Eigensolver (VQE), they have demonstrated substantial improvements in portfolio and risk assessments by solving optimization problems faster and more effectively than classical computers.

Applications in Financial Services

- Portfolio Optimization: Quantum computing enhances portfolio optimization by rapidly evaluating multiple portfolio combinations to find optimal asset allocations. Traditional algorithms often struggle with this level of complexity, especially as portfolio sizes grow. Quantum algorithms, such as QAOA and VQE, have shown promising results in minimizing risk and maximizing returns by quickly evaluating complex financial models.

- Risk Management and Conditional Value at Risk (CVaR): Quantum computing brings increased precision to risk assessment by enabling efficient calculation of metrics like CVaR. CVaR focuses on expected losses in worst-case scenarios, a valuable measure for financial institutions managing high-risk investments. For instance, IBM’s quantum solutions have been successfully applied to optimize CVaR calculations, offering a powerful tool for navigating market volatility.

- Derivatives Pricing: Monte Carlo simulations are a core technique in derivatives pricing but are highly resource intensive. Quantum computers can significantly reduce computation time for these simulations, allowing financial firms to value derivatives faster and with greater accuracy.

- Fraud Detection and Anomaly Detection: Quantum machine learning models offer substantial improvements in identifying fraudulent activities and anomalies by processing more variables at a faster rate. This enhanced processing power is critical as fraud schemes become increasingly sophisticated and data-heavy.

Source: CIO Influence

Key Quantum Computing Companies in Finance

Several companies are pioneering quantum computing innovations relevant to the finance sector:

IBM: As a pioneer in quantum computing, IBM provides cloud-based quantum computing access through platforms like IBM Quantum Composer and Qiskit, an open-source quantum development kit. IBM’s advancements in VQE and QAOA applications are directly applicable to portfolio and risk management in finance, making it a key player for institutions looking to leverage quantum power for finance applications.

NVIDIA: Known for its expertise in high-performance computing, NVIDIA is partnering with quantum firms to enhance quantum simulation and machine learning. Their CUDA Quantum software facilitates quantum tasks, making it adaptable to finance-focused machine learning applications and anomaly detection.

Emerging Quantum Computing Companies

IonQ: IonQ, a leader in trapped-ion quantum computing, became the first publicly traded quantum computing company in 2021 through a merger with dMY Technology Group. Its listing marked a milestone, drawing attention to IonQ’s unique ion-trap technology, which promises higher fidelity and scalability than many alternatives. IonQ has since invested in partnerships with companies like Google and Microsoft to integrate quantum capabilities into their cloud platforms, making quantum resources more accessible for enterprise clients.

Rigetti Computing: Rigetti has positioned itself as a pioneer in hybrid quantum-classical computing, which is particularly suitable for optimization tasks where both quantum and classical resources can be leveraged. Rigetti’s approach targets the financial sector, where hybrid models enable faster and more cost-effective calculations for complex simulations and optimizations.

D-Wave Systems: D-Wave’s quantum annealing approach is designed to tackle optimization problems more efficiently. The company is well positioned to serve industries with extensive logistical challenges, like supply chain management as well as the finance sector. D-Wave has made recent strides by launching the Advantage Quantum Cloud Service, enabling companies to access quantum optimization via cloud services for tasks ranging from logistics to financial portfolio optimizations.

Quantum Computing Inc: Quantum Computing Inc. is creating user-friendly quantum solutions tailored to industries like finance, where end-users may not need in-depth quantum expertise. In a recent development, QCI has launched Qatalyst, a quantum software platform designed to simplify access to quantum algorithms. By focusing on software and usability, QCI aims to open the doors of quantum computing to a broader audience, including financial firms seeking efficient optimization solutions without heavy upfront hardware investments.

Quantum Computing’s Future in Finance

Quantum computing holds the potential to redefine finance. By transforming how firms approach portfolio optimization, risk management, and derivatives pricing, quantum technology offers new ways to enhance profitability and mitigate risk. Major financial institutions are already investing in quantum research and development, partnering with firms like IBM and IonQ to test and deploy quantum algorithms tailored to their needs. Over the next five to ten years, quantum computing is expected to transition from experimental use to more mainstream applications as system reliability improves.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.